Decentralized Exchanges (DEXs) are emerging as a cornerstone of the crypto economy, offering users unparalleled transparency, and security. However, building a DEX from scratch can be complex and resource-intensive, especially for startups aiming to capitalize on the growing DeFi wave.

On the other hand, White Label DEX solutions allow businesses to launch decentralized exchanges without facing technical challenges. With the help of this White Label solution, startups can focus on their branding and marketing strategies. In this competitive DeFi sector, choosing a White Label Decentralized Exchange is a smart way to enter the market swiftly and confidently.

In this blog, let’s explore everything you need to know about choosing a White Label Solution to build a Decentralized Exchange Platform.

We’ll Start with…

White Label Decentralized Exchange Software – An Overview

A White Label Decentralized Exchange software is a ready-made solution enabling businesses to launch their own DEX platforms without building one from scratch. This software typically includes essential features like automated market-making, wallet integration, liquidity pools, and support for various blockchain networks. White Label DEX solutions are designed to be highly customizable, allowing businesses to rebrand the platform with their logo, design, and preferred functionalities.

As a pioneer, Coinsclone leverages cutting-edge technologies and industry trends to deliver exceptional White Label decentralized exchange solutions. Our expertly crafted DEX platforms support a wide range of cryptocurrencies and token standards, ensuring seamless trading experiences for users. With a team of skilled developers dedicated to staying ahead of market advancements, Coinsclone ensures that your platform is equipped with the latest features and functionalities to thrive in the competitive crypto ecosystem.

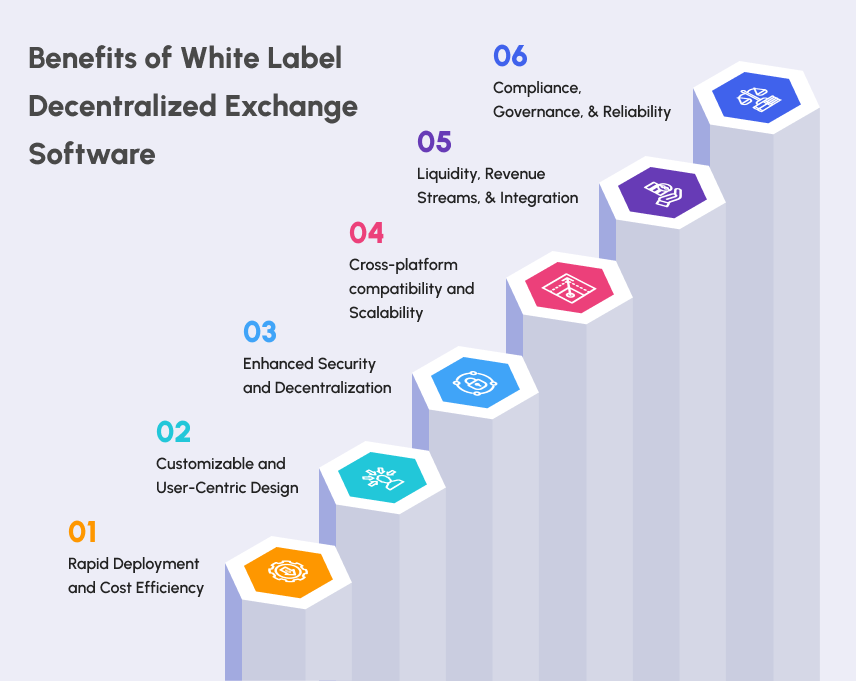

Benefits of Our White Label Decentralized Exchange Development

Our White Label decentralized exchange (DEX) development solution offers startups and businesses a seamless pathway to launch their unique DEX platforms. Packed with customizable features and robust functionalities, it ensures that you save time, reduce costs, and focus on business growth. Here’s a detailed look at the benefits:

1. Rapid Deployment and Cost Efficiency

Launch your decentralized exchange in weeks with our ready-made solution that requires minimal modifications. This approach significantly reduces development time and costs compared to building from scratch, allowing you to allocate resources to other business priorities.

2. Customizable and User-Centric Design

Create a unique platform tailored to your brand by customizing the user interface, trading pairs, and functionalities. The intuitive and user-friendly interface ensures seamless navigation, simplified transaction processes, and real-time order book access, enhancing user satisfaction and retention.

3. Enhanced Security and Decentralization

Our platform incorporates advanced encryption protocols, multi-signature wallets, and secure smart contracts to safeguard user funds and data. The decentralized architecture eliminates intermediaries, providing users full control over their assets while ensuring faster transactions, transparency, and reduced operational risks.

4. Cross-platform Compatibility and Scalability

Designed for seamless performance across desktops and mobile devices, our DEX ensures a smooth trading experience for users on any device. Built on a scalable architecture, the platform can handle increased trading volumes as your exchange grows, ensuring uninterrupted performance during peak activity.

5. Liquidity, Revenue Streams, and Integration

Integrated with leading liquidity providers, the platform ensures sufficient trading volume from day one. Monetize your exchange with various revenue streams, including transaction fees, token listing fees, staking services, and premium subscriptions. Seamless integration with wallets, blockchain networks, and external APIs supports diverse cryptocurrencies and token standards, enhancing user convenience.

6. Compliance, Governance, and Reliability

Meet global compliance standards with built-in KYC/AML integration, making it easier to operate in regulated markets while maintaining user privacy. Community governance features, such as DAO support, foster user engagement and loyalty. The platform undergoes rigorous testing to ensure it is bug-free and operates reliably, minimizing downtime and maximizing trust.

Overall, our White Label decentralized exchange helps you enter the market quickly while providing great flexibility, security, and scalability. With a strong and user-friendly platform, you can stay ahead of your competitors and meet the growing needs of cryptocurrency traders.

Top Trending White Label Decentralized Exchange Platforms

Here is a list of all the trending Decentralized exchanges in the market that White Label decentralized exchange software can be customized to fit.

- Uniswap (V3)

- dYdX

- DODO

- Curve Finance

- Jupiter

- SushiSwap

- THORChain

- Biswap

- Sun.io

- ShibaSwap

Understanding the performance of top decentralized exchanges is crucial for startups. We’ve analyzed the best DEXs, highlighting their pros and cons to guide your journey. With crypto adoption growing and DeFi poised for long-term success, partnering with a reliable White Label software provider like Coinsclone can help you launch your DeFi exchange efficiently.

Features of Our White Label Decentralized Exchange Development

Integrating essential features and additional features will ensure a seamless trading experience for users while empowering businesses to stay competitive in the dynamic crypto space.

Essential Features

Decentralized Trading

Users can trade cryptocurrencies directly from their wallets without intermediaries, ensuring privacy and security.

Smart Contract Integration

The platform uses secure and transparent smart contracts to execute trades, eliminating the need for trust in third parties.

Multi-Currency Support

Supports a wide range of cryptocurrencies and tokens, ensuring flexibility for traders.

Secure Wallet Integration

Built-in wallet support allows users to store, manage, and trade assets seamlessly on the platform.

Advanced Order Types

Offers market, limit, and stop-loss orders, enabling users to trade with precision and control.

Real-Time Order Matching

Fast and efficient order matching ensures trades are executed instantly and accurately.

Liquidity Integration

Ensures smooth trading by integrating with liquidity pools and providers, reducing slippage, and enhancing user experience.

KYC/AML Compliance

Integrates optional KYC and AML processes to ensure regulatory compliance and foster trust.

User-Friendly Interface

An intuitive dashboard with streamlined navigation makes it easy for users to access trading tools and analytics.

Robust Security Protocols

Features like encryption, two-factor authentication (2FA), and multi-signature wallets protect user assets and data.

Additional Features

Staking and Yield Farming

Allows users to stake tokens and participate in yield farming, generating passive income while boosting platform engagement.

Governance Features

Enables community-driven decision-making via DAO mechanisms, fostering user loyalty and decentralization.

Multi-Blockchain Compatibility

Supports multiple blockchain networks, such as Ethereum, Binance Smart Chain, and Polygon, for diversified trading.

Token Listing Module

Allows projects to list new tokens, providing exposure and increasing trading options for users.

Mobile App Compatibility

A mobile-friendly platform or dedicated app ensures users can trade on the go.

Analytics and Reporting Tools

Provides real-time insights and detailed reports on trading activity, volume, and market trends.

Referral Program

Built-in referral systems incentivize users to invite others, helping to grow the platform’s user base.

Customizable Fee Structures

Platform owners can define trading fees, withdrawal fees, and more to maximize revenue.

NFT Marketplace Integration

Adds an NFT trading module for users interested in digital collectibles, expanding platform functionality.

Multi-Language Support

Ensures global accessibility with support for multiple languages, catering to users worldwide.

These features collectively make our White Label decentralized exchange a robust, secure, and user-centric platform that adapts to market demands while supporting business growth.

Now let us explore the…

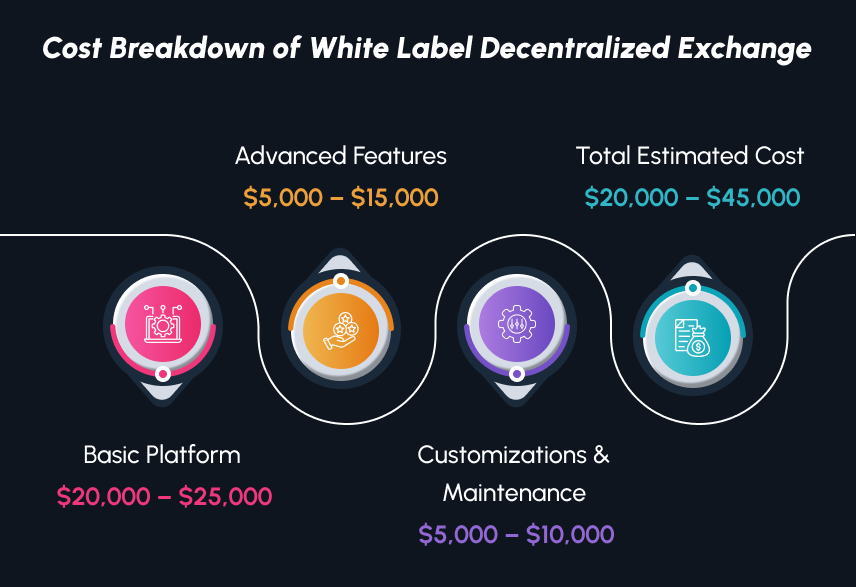

Cost to Develop a White Label Decentralized Exchange Development

The cost of a white label Decentralized Exchange typically depends on the features and functionalities. With this solution, you can save significant time and resources compared to building a platform from scratch. For businesses with limited budgets, it is an efficient and low-risk way to enter the market while ensuring scalability and user satisfaction.

Here is the cost breakdown of the White Label Decentralized Exchange Solution.

At Coinsclone, we prioritize delivering high-quality white label solutions that balance affordability, security, and performance. Though our prices may differ slightly, they reflect the superior value and reliability of our platforms, making them the ideal choice for forward-thinking businesses.

With our White Label decentralized exchange solution, you gain access to a cost-effective and efficient way to enter the competitive crypto market. But how do you maximize your return on investment? Discover the diverse revenue streams our White Label decentralized exchange software offers in the next section.

Revenue Model of White Label Decentralized Exchange Software

The revenue model of White Label Decentralized Exchange software revolves around multiple streams designed to generate income for platform operators and incentivize user participation.

- Transaction Fees – Charge a small percentage or fixed fee on each trade executed on the platform. This is the primary revenue source for most exchanges, as it ensures a steady income stream based on trading volume.

- Listing Fees – Earn revenue by allowing crypto projects to list their tokens or coins on your platform for a fee. This model is especially lucrative if your exchange gains a reputation for high liquidity and user traffic.

- Staking and Yield Farming Services – Generate revenue by offering staking and yield farming options where the platform takes a percentage of the rewards earned by users.

- Subscription Plans – Offer premium services, such as advanced trading tools, analytics, or reduced transaction fees, through subscription-based plans.

- Referral Program Commission – Earn indirect revenue by implementing a referral program where users are incentivized to bring more traders to the platform, boosting overall trading activity and fee income.

- Token Launchpad Services – Provide an Initial DEX Offering (IDO) or token launchpad service, charging projects a fee to raise funds through your exchange.

- Advertisement and Sponsored Content – Allow crypto projects or businesses to advertise on your platform through banners, featured listings, or sponsored content, creating an additional revenue stream.

So far, we have discussed the main ways a White Label DEX Platform can make money. This shows that starting a White Label Decentralized Exchange Platform is a good chance for established businesses and a great opportunity for startups. Delaying entry into the market can result in missed chances to attract early users and build a strong customer base. So, it is time to…

Kickstart your White Label Decentralized Exchange Platform Now

The demand for decentralized exchanges is rapidly increasing day by day. By opting for a White Label solution, you can avoid the technical challenges and high costs associated with building a DEX from the ground up. This enables you to concentrate on growing your business and gaining market share.

Don’t miss the chance to enter the rapidly growing DeFi ecosystem. Take action now to launch your own decentralized exchange platform using a White Label solution, positioning your venture for long-term success in the crypto industry.

So now are you ready to take the leap and build your decentralized exchange? Here is…

Launch your DEX effortlessly with Coinsclone’s White-Label Decentralized Exchange Software.

Start your crypto trading platform with advanced features today! Live Demo Available.

Your One-Stop White Label Decentralized Exchange Development Partner – Coinsclone

Coinsclone specializes in crafting tailored White Label decentralized exchange solutions designed to help businesses thrive in the competitive DeFi space. From robust security features to seamless integrations with popular blockchain networks, our platforms are built with cutting-edge technologies to deliver unmatched reliability and performance.

Whether you’re a startup or an established enterprise, our team ensures a smooth and efficient development process, empowering you to launch your exchange with confidence and speed. Partner with Coinsclone to turn your vision into reality and lead the way in the decentralized revolution!