Decentralized Finance (DeFi) applications are transforming the world of finance by cutting out intermediaries and facilitating direct peer-to-peer transactions. For startups, developing a DeFi app offers an exciting chance to get in on a rapidly expanding, cutting-edge market. With billions invested in DeFi protocols, users continue to demand safe, easy-to-use, and scalable solutions. Whether you’re planning to launch a DEX, a lending protocol, or a yield aggregator, the future is yours to create.

In this guide, we will take you through the step-by-step process of how to create a DeFi app. You will also learn the main advantages, typical challenges, and real-world tips to develop your DeFi App without any hassles.

What is a DeFi App?

A DeFi (Decentralized Finance) is a blockchain application that delivers financial services such as trading, lending, and borrowing without intermediaries like banks. Developed on platforms such as Ethereum, DeFi applications allow for direct, trustless engagement with financial protocols, guaranteeing secure and verifiable transactions using smart contracts.

The primary objective of DeFi applications is to democratize access to financial instruments, making it possible for users to hold control over their funds through decentralized wallets. Users can get rewards in the form of liquidity provision and staking, minimizing operation costs while unlocking streams of income such as yield farming. Different DeFi applications exist, each with distinct characteristics and revenue streams that facilitate the accomplishment of DeFi startup objectives.

Types of DeFi Apps to Look Out for in 2025

There are plenty of opportunities for entrepreneurs to develop new DeFi applications. Whether you’re a beginner in the field or seeking to diversify your business portfolio, learning about various types of DeFi applications will enable you to spot a sustainable, profitable opportunity.

1. Decentralized Exchange (DEX)

DEX is the platforms that allow traders to trade cryptocurrencies without an intermediary. The absence of a central authority brings simple trading while offering quicker trade execution. Similar to its efficiency, the chances of generating huge income with DEXs are also achievable. So, if you intend to create a DeFi app for DEX, implement more services for better profits. You can implement yield farming, swapping, and similar features. Consider creating a Decentralized Exchange like Uniswap or LocalBitcoins to tap into established markets. Revenue comes from trading fees, staking services, and additional DeFi features.

2. DeFi Lending and Borrowing Apps

DeFi lending and borrowing apps are also beneficial to startups considering their profit potential. In simple words, these apps offer banking services to users who need funding support. The smart contract will manage the funding and transactions effectively. So the lending and borrowing app will provide the required speed and security. As a platform owner, you can earn interest and commission while executing the transaction. Building a decentralized lending platform like Aave, enabling peer-to-peer borrowing with smart contract automation.

3. DeFi Staking Platform

As Proof-of-Stake (PoS) networks expand, staking is now a highly sought-after source of passive income by locking up tokens to support the network security. Build a multi-currency DeFi staking platform that provides high APYs. Include gamification, social functionalities, or programmable staking pools to attract users. As demand for passive income tools continues to rise, launching a DeFi Staking platform like PancakeSwap will make a difference and be lucrative for startups. Learning tools such as staking calculators can also onboard new entrants.

4. DeFi Yield Farming Platform

Yield farming enables users to gain returns through liquidity provision to protocols. These yield farming platforms aggregate leading DeFi farms and automate strategy deployment. Create smart vaults that balance risk and returns, with real-time analytics dashboards. With investors looking for high-yield, low-effort solutions, a well-crafted platform can generate broad user interest. Creating a DeFi Yield Farming Platform like Yearn Finance brings opportunities for many aspiring entrepreneurs.

5. DeFi Crowdfunding Platform

DeFi crowdfunding eliminates barriers to traditional fundraising. Global tokenized investment opportunities are enabled by these platforms. So what is special here is the secure and automated procedures resulting in quicker fundraising. Owning such platforms not only helps you in quicker fundraising. But also enables you to make a profit in terms of business usage. Recently, many decentralized autonomous organizations have supported such services for their community. You can consider creating a DAO as well. If you want to create opportunities for many startups, you can develop a DeFi crowdfunding platform like Plokastarter, where they can raise funds via crypto.

6. DeFi Asset Management Platform

As DeFi investments are diversified across several protocols, users require centralized tools to optimize and manage their portfolios. Create an asset management platform that consolidates portfolios from different DeFi sources. Provide features such as rebalancing, risk scoring, smart suggestions, and tax optimization. Target retail and institutional users who need sophisticated tracking tools. As DeFi complexity grows, asset management tools will be crucial to user success.

By tapping into these DeFi verticals, entrepreneurs can create innovative platforms with multiple revenue streams and high user demand, positioning themselves at the forefront of decentralized finance.

Why Should Startups Build a DeFi App in 2025?

The emergence of DeFi has redefined how individuals are accessing and holding financial services, unlocking doors for innovation, decentralization, and global access. For startups, building a DeFi app is not merely about jumping on a trend, it’s about entering a future-proof space with scalable business and global ambitions.

Easy Accessibility – DeFi applications simply connect global users with decentralized services via an easy interface. The user can access the services from wherever they are without cross-border restrictions via the internet.

Cost-effectiveness – The Decentralized Finance application functionalities are powered by a simple network infrastructure. So, overall development and operational costs will come under your budget.

Innovation – Decentralized Finance app development is an ideal business idea to visualize your innovations. Since the DeFi space is constantly growing, future upgrades will benefit your startup business well.

Profit Potential – Generally, there is a belief that DeFi platforms have lower profit potential. But the reality is that it depends upon the income streams the platform has. So, create a DeFi app with more services that help you generate more income.

Community Guidance – Decentralized platforms and applications have an active community of people. They effectively participate in the growth of DeFi applications. Thus, your decentralized app will be technically refined to compete in the crypto space.

Thus, considering the earnings and future growth, DeFi app development becomes a balanced startup idea. That’s why novice investors are searching for how to create a DeFi App.

So let us see…

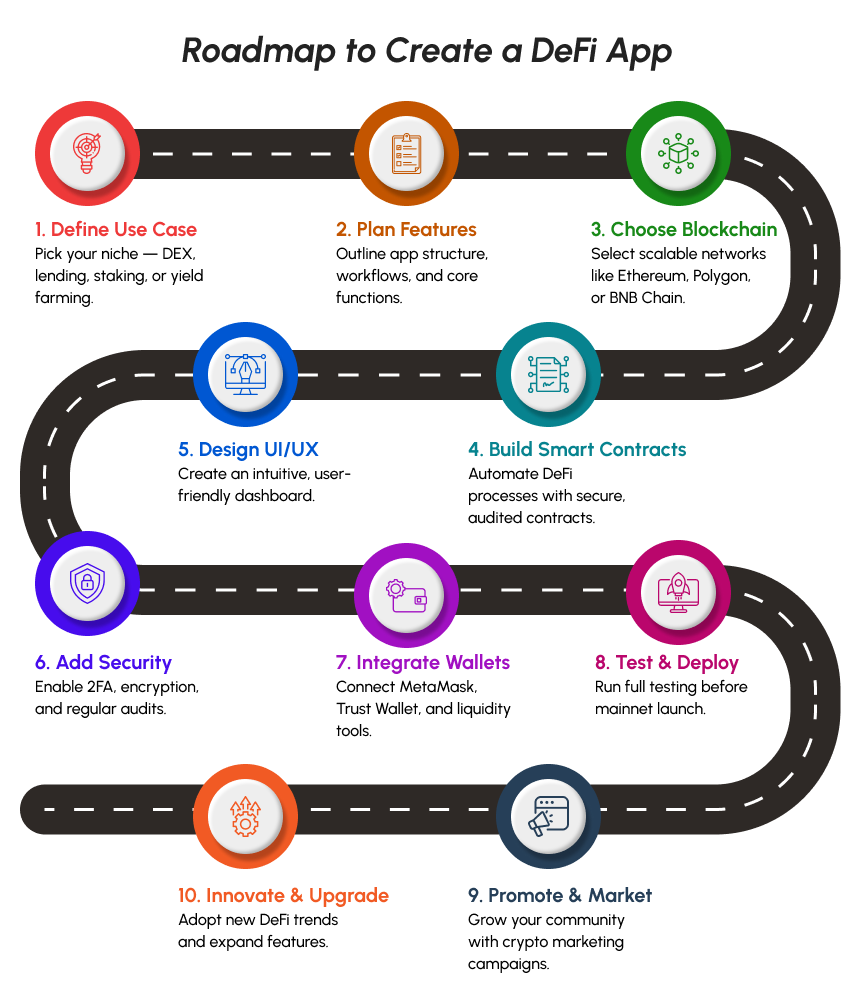

How to Create a DeFi App in 10 Easy Steps?

To create a DeFi app, start by defining your use case and target audience, then design and develop smart contracts using blockchain platforms and integrate user-friendly interfaces for interaction with the decentralized finance protocols. Let’s see the details in 10 simple steps.

STEP 1 – Define the DeFi Use Case

You should have a clear vision of its use cases before creating a DeFi app. This is the important step that determines the business type, service offerings, and target audience. You may create a DeFi app for DEX, payment gateway, lending and borrowing, and more DeFi use cases. Accordingly, the business benefits, nature of the app, and working principle will vary. So be clear on the use cases to get more impressions from the target users.

STEP 2 – Determine App Features and Architecture

This is the step to determine the architecture and features of the DeFi app. Based on the finalized use cases, build a DeFi app that has attractive features and powerful infrastructure. This may include smart contract programming, wallet and payment gateway integration, liquidity pools, and more. The right set of features will make the app support scalability, flexibility, and interoperability.

STEP 3 – Select Appropriate Blockchain

Blockchain is a fundamental component for deploying and creating your DeFi app. To create a DeFi application in a determined way, you need an effective blockchain. The most popular blockchain for DeFi app development is the Ethereum blockchain. However, if you prefer quicker transactions with gas fee advantages, you may prefer other blockchains. BNB Chain, Polygon, Solana, and Avalanche are the blockchains worth mentioning here.

STEP 4 – Prepare Smart Contract

When it comes to DeFi projects, the role of smart contracts is more significant. This self-executing protocol automates the DeFi app operations as per its application. It doesn’t need any supervision while ensuring security and reliability at the top class. So, define your smart contract functionalities efficiently via a suitable programming language. Since all DeFi app functionalities depend on smart contracts, give some extra attention here.

STEP 5 – Complete UI/UX Development

This is the step where the design and development process of the DeFi app begins. The user interface should be easily accessible to all types of users. Creating your Defi application with user-demanding features and convenience is a great move. So that basic users can navigate through the app smoothly. As a result, your decentralized finance application will have engaged user contributions as well.

STEP 6 – Implement Security Measures

Blockchain technology and smart contracts ensure secure operations for your Decentralized Finance applications. However, to create a DeFi app with top-notch protection, security protocols become essential. So often conduct security auditing to ensure secure cryptography, encryption, and data management.

STEP 7 – Connect with Wallet and APIs

For any business model, a secure crypto wallet is essential to keep your assets safe. So your DeFi app should be capable of integrating with relevant crypto wallets. Besides, connecting your Defi application with other APIs enhances app accessibility. Overall, this will increase the business traction and opportunities as well.

STEP 8 – Testing and Deployment

So now your DeFi app is almost ready to come into use. However, the DeFi app should be tested for its performance and world-class security. Hence, conduct security checkups on security protocols to remove the flaws. Once you have done this, the Defi app is now ready for deployment.

STEP 9 – Conduct Promotions and Marketing

Marketing activities are the front-end resource to promote your decentralized finance app. So, tie up with marketing channels and conduct internal promotional activities. This will improve the reach of a DeFi app. You can use marketing tools and strategies to check whether you are on the right path.

STEP 10 – Upgrades and Innovations

DeFi application development is the new business model in the crypto space. The future will add more options and possibilities to explore further. So, to keep your business up to market standards, frequent upgrades become essential. Hence, implement upgrade plans to ensure seamless and secure DeFi app operations.

With these step-by-step procedures, you may now know how to create a DeFi App effectively. Following these procedures removes the barriers to creating a DeFi app for your startup. So now let us explore the…..

Various Methods of DeFi App Development

The development method you choose may depend on your budget, business needs, and time. That is why it is important to learn the prominent methods to create a DeFi app. The two prominent methods are…

- DeFi App Development from Scratch

- Using DeFi App Clone Script

DeFi App Development from Scratch

Developing a DeFi app from scratch involves starting from the beginning. This method provides full control over your app’s features, look, and scalability. However, it requires more development time, technical expertise, and investment. But if you’re aiming for long-term growth and want to stand out in the market, this method offers the most potential.

Using DeFi App Clone Scripts

Utilizing DeFi clone scripts is an instant solution as it provides quicker deployment and affordability. They are pre-built, application-specific software solutions mimicking the essential features of leading DeFi platforms. This approach is most suitable for entrepreneurs who wish to test their business concept through a tried-and-tested model before scaling it even more.

Overall, choosing these methods is totally based on your business needs. But whatever method you choose, partnering with a reliable DeFi app development company will ensure a smoother and more secure development process. Expert developers bring valuable insights, technical know-how, and post-launch support that can shape your DeFi startup’s success.

So far, we have discussed different types and how to create a DeFi app efficiently. Understanding their incredible features and profit potential, you may now be interested in building a DeFi app. However, before rushing, let us explore the…

Top Challenges in DeFi App Development & How to Overcome Them

Creating a DeFi app may look simple when you see it from a startup perspective. However, considering the security and programming skills, creating a DeFi app needs keen supervision. Let us explore the challenges associated with them one by one.

Security Concerns – The default security of blockchain is good enough to keep your DeFi application safe. However, the increasing data breaches and security risks necessitate higher-end security measures.

Blockchain Scalability – Whenever the usage of the decentralized finance app increases, the app should be capable of adapting to the usage and workload. So, choose the blockchain that offers more scalability to increase the performance and outcomes of the DeFi app.

Liquidity Needs – One of the major issues in the decentralized ecosystem is liquidity. Till reaching the default level of user contribution, a DeFi app may have lower liquidity.

Legal Regulatory Issues – The DeFi landscape is still in the growing phase in many global nations. Hence, there are not enough regulatory laws, and many startups are unaware of them completely.

Market Awareness – The DeFi application may have lower user visits if promotions and marketing are insufficient. The decentralized finance application with attractive features can easily grab the market demand.

These are some of the most common challenges that startups may face during DeFi app development. If you’re a newbie, struggling to overcome these hurdles, or unsure where to begin, it’s wise to partner with a leading DeFi app development company.

One such trusted name in the industry is Coinsclone. With years of experience and a skilled blockchain development team, Coinsclone helps you create a secure, scalable, and feature-rich DeFi app from scratch or using clone scripts, tailored to your unique business model.

Why Choose Coinsclone to Create a DeFi App?

Coinsclone is a leading DeFi app development company trusted by startups and enterprises across the globe. We have a team of experts who have vast experience in smart contract programming and blockchain app development. We believe in client-friendly development, which aims to deliver a secure, reliable, and feature-loaded application that meets your business expectations.

So, rather than worrying about the intricacies of development, entrust your vision to our professionals. Let’s work together to create a DeFi app that not only complies with today’s market requirements but also puts your startup on the way to success in the decentralized world.

Want to launch your DeFi app in weeks? Talk to our blockchain experts at Coinsclone

Cost-effective, White-Label Solution, Premium Features, Customizable.

Frequently Asked Questions (FAQ)

How much does it cost to build a DeFi app?

When it comes to DeFi app development, it involves certain factors. The approximate cost to create a DeFi app would range between $15,000 and 45,000 based on the customization and development hours needed.

How do I make money using a DeFi app?

You can earn money with a DeFi app by charging transaction fees, offering staking rewards, providing liquidity pools, and implementing yield farming strategies. Additionally, lending and borrowing features can generate interest and commissions.

What are the key steps in DeFi app development?

Developing a DeFi application entails having your use case defined, picking a blockchain network, developing smart contracts, architecting the UI/UX, integrating wallets, testing, and deploying the application at last. Regular updates and security audits ensure long-term success.

Which are the top DeFi applications to be on the lookout for in 2025?

Some of the best DeFi apps in 2025 include Uniswap (DEX), Aave (Lending & Borrowing), Yearn Finance (Yield Farming), and Compound (Lending Platform). These exchanges have been impressive in terms of user acquisition, security, and innovation.

What are the best non-KYC crypto exchanges?

Some of the best non-KYC crypto exchanges are P2P sites such as LocalBitcoins, Bisq, and Uniswap (DEX). They permit users to exchange cryptocurrencies without having to provide identification, which provides greater privacy.

What should a DeFi app offer?

An effective DeFi app must feature smart contract integration, multi-currency wallet support, and core functionalities such as staking platforms and yield farming, along with robust security protocols and an intuitive interface for easy navigation.