Presently, the DeFi landscape is redefining the world of cryptocurrency and the blockchain ecosystem. Without relying on traditional banks and intermediaries, the DeFi platforms are working seamlessly to offer better trades. Along with the trading options, now DeFi users can lend/borrow crypto assets for better yields.

The specialized DeFi platforms help users to enable permissionless access to liquidity, transparent interest rates, and global participation with the crypto wallet. As decentralized finance continues to mature, the DeFi lending protocols are also evolving beyond basic money markets to offer capital efficiency.

Among numerous DeFi lending platforms, we have curated the top DeFi lending platforms of 2026. Through this, you can pick the right platform for your next DeFi lending process.

Launch Your DeFi Lending Platform Faster With a Proven MVP System

Top DeFi Lending Platform Development — Built for Scale, Security, and Cost-Efficiency

- MVP System :Launch your top DeFi lending platform up to 90% faster.

- Real-Time Data Engine : Core lending logic, interest rate models, collateral management, and liquidation modules pre-integrated — no complex development required.

- Brand & Customization : Your assets, your collateral rules, your interest rates, your UI, your governance.

- Revenue Engine :Earn from lending interest spreads, borrowing fees, liquidation incentives, and protocol parameters.

Get a free branded demo of your DeFi lending platform MVP within 48 hours — before committing to development.

Book a free strategy call to see how our DeFi lending platform MVP can take you from idea to a live, production-ready protocol in as little as 2–4 weeks.

What is a DeFi Lending Platform?

A DeFi lending platform is a decentralized financial application that allows crypto users to lend and borrow assets without relying on banks. These platforms operate on blockchain networks and utilize smart contracts to automate lending, borrowing, and interest calculation in a trustless manner. The DeFi lending process helps users to borrow high-value crypto assets by backing them with collateral.

The lending process is done seamlessly by the platform based on the supply and demand that ensures market-driven pricing. Along with that, DeFi lending platforms allow users to deposit crypto assets into liquidity pools and earn interest, while borrowers can access funds. As the transactions are executed on the blockchain network, all activities such as loan terms, collateral ratios, and repayments are publicly verifiable. Unlike the traditional lending/borrowing platforms, only the top DeFi lending platforms are globally accessible.

Benefits of the DeFi Lending Platforms

With the launch of top DeFi lending platforms, both DeFi users and DeFi lending platform startups are gaining significant benefits. Some of them are listed below in detail.

Permissionless Transactions

Being a DeFi lending platform with open access means that any person with a crypto wallet can access the DeFi applications. There is no need for authorization when trading that allows users to access the system for buying, selling, and trading DeFi assets.

Cost-efficiency

Our DeFi lending platform development can be done in a cost-efficient way. We create and develop the lending platform at a minimal cost. Our development services are the best; quality is never compromised for cost at any stage.

Decentralization and Automation

The top DeFi lending platforms are decentralized, and transactions are automatically enforced by smart contracts, thereby fast-tracking transaction processing, avoiding human errors, and providing scalability.

Transparency and Accessibility

The DeFi lending platform is transparent to the core, where the transaction histories are auto-recorded and saved, so users can always refer to them whenever there is a need and recover lost data. They make seamless access available without any roadblocks.

Time-efficient Trading

Our top DeFi lending platforms keep trades brief, wherein users do not need to invest much time in trading. Our agile development process and the functionality of the smart contract enable quick transactions.

It simply means that DeFi takes the wider area of finance and democratizes it, thus making lending far more accessible and user-friendly than it ever was. Now, it is the right time to know about the top DeFi lending platforms of 2026.

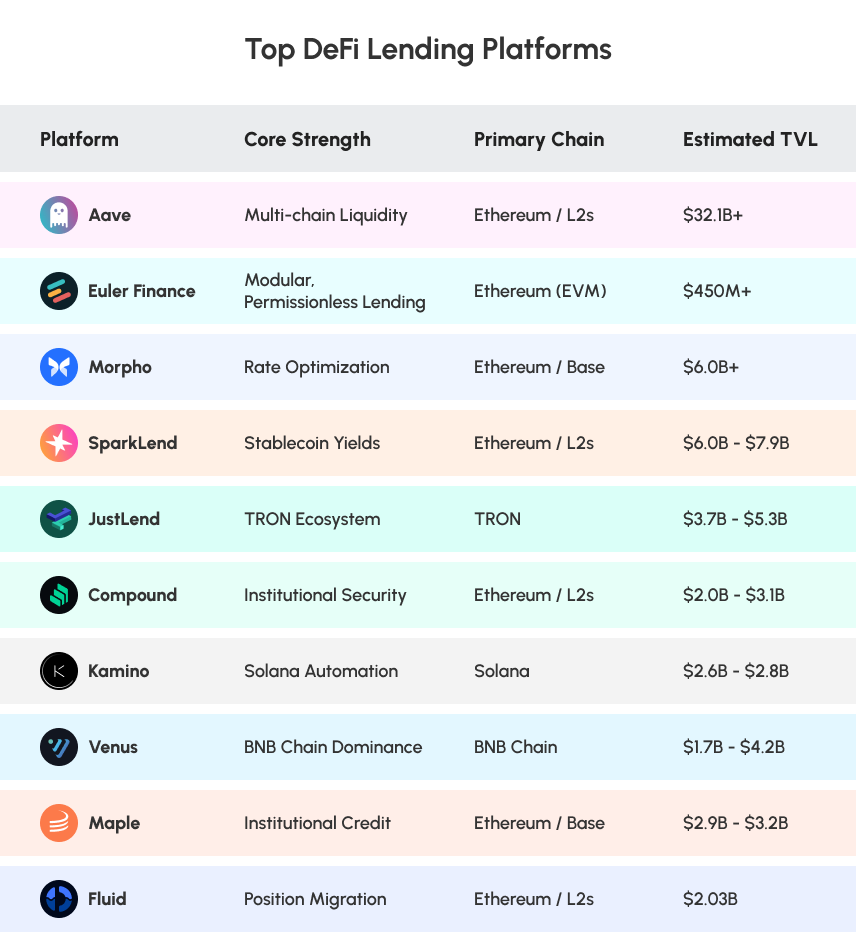

Top 10 DeFi Lending Platforms 2026

Based on various criteria, we have given the list of top DeFi lending platforms 2026 for startups and users. Each DeFi lending platform has its own features, functionalities, and modules for a top-notch functioning.

Aave

Aave is one of the leading and largest decentralized lending markets in the DeFi ecosystem, where they help a wide range of users to lend assets. By keeping a crypto asset as collateral, users can lend or borrow for a higher value. The Aave DeFi lending platform is backed by a potential smart contract where the transactions are done exponentially without any intermediaries.

Key Features

- The platform offers multi-chain support features where transactions can be done on Ethereum, Arbitrium, Polygon, and other EVM chains.

- The Aave platform offers flexible interest rates for hassle-free borrowing.

Morpho

Morpho is also a leading DeFi lending platform that stands tall among the existing DeFi platforms. The platform helps to match the lenders directly with the borrowers to improve the capital efficiency and rates. The platform users can streamline a unique trading strategy to reap higher profits.

Key Features

- The platform helps users to automatically use the underlying liquidity pools for higher chances of a direct match. This increases the overall liquidity in every pool.

- The ‘Morpho blue’ feature enables customizable DeFi markets and a lending platform for specified crypto assets.

SparkLend (Spark Protocol)

The SparkLend DeFi protocol comprises a broader Spark ecosystem that has been backed with an Aave-derived stack. The platform focuses on a wide range of stablecoins for global users and offers an efficient trading experience. The platform is designed to generate yield for lenders through integrated savings layers.

Key Features

- Without relying on third-party capital, the platform offers a potential liquidity option for its users.

- The platform is built to ensure transparency, security, and reliability for stablecoin lending and borrowing.

Compound

The Compound was a pioneer in the DeFi lending protocol, where users can supply crypto to earn higher returns. With the potential interest rate modules of the platform, both the supply and demand of the platform are balanced. The platform is built with streamlined algorithms that adjust the crypto asset utilization.

Key Features

- The lenders of the platform receive cTokens (native token of the platform) that help to accure interst across various DeFi platforms.

- The platform has multi-chain accessibility where it operates on Ethereum, Polygon, Arbitrum, Base, and more.

JustLend DAO

The JustLend DAO is a primary DeFi lending protocol that is backed on the Tron blockchain. The platform offers fast and low-fee lending/borrowing services within the Tron ecosystem. As the platform runs on the Tron blockchain, it has a ultra low fees for the users, which ensures cost-efficient lending.

Key Features

- With the TRX ecosystem integration, the platform offers multiple opportunities for lending, borrowing, trading, etc., beyond the platform.

- With the native token (JST token), the holders can participate in DAO governance activities.

Venus Protocol

The Venus protocol is a decentralized money market protocol that is backed by the BNB chain and EVM-compatible blockchains. The platform offers a smooth and secure lending/borrowing of native stablecoin (VAI). The VAI tokens can be minted for borrowing purposes against collateral.

Key Features

- The platform possesses a high-tech algorithmic money markets where is functions similarly to Compound with flexible interest models.

- With the flexible collateral factors, BEP20 crypto tokens are also supported.

Euler Finance

Euler is a growing modern lending platform that allows users to lend, borrow, and create customizable valuts. Depending on the risk and asset parameters, custom vaults can be created for passive income. Across the DeFi market, users can collateralize and borrow multiple crypto assets.

Key Features

- The vault isolation feature helps to optimize the capital without increasing the risk for loss.

- The token holders can participate in the Euler DAO for community-driven upgrades.

Kamino Lend

The Kamino lend is a part of the Kamino finance ecosystem that is backed by the Solana blockchain. The platform combines both the lending markets with concentrated liquidity and yield strategies. With the integrated specialized tools, the crypto assets possess leveraged positions.

Key Features

- The Solana ecosystem integration offers fast, low-cost lending for Solana-native assets.

- The platform is known for high LTV options that support aggressive borrowing against SOL and stablecoins.

Fluid Lending/Fluid Finance

The Fluid Finance is a rising capital-efficiency lending protocol on the EVM network (Ethereum, Base, Arbitrum). The smart collateral feature helps to earn trading fees via the integrated DEX pools. The platform has a cross-chain presence feature, where it is available on major EVM networks for diversified liquidity.

Key Features

- The efficient liquidation mechanism helps to reduce the borrower’s cost drastically.

- With the zero fee mechanism, the platform focuses on miner efficiency and cost savings.

Maple Finance

The Maple Finance is a popular DeFi lending platform that is built for institutional and large-scale lending transactions. The platform features permissioned pools and real-world use cases for structured finance on-chain. All the loan activities and terms are verifiable on-chain.

Key Features

- The platform combines traditional risk management with blockchain transparency.

- The protocol token holders share the revenue and buybacks tied to the performance.

These are the top 10 DeFi lending platforms that are popular in 2026. These DeFi protocols collectively represent the evolving landscape of decentralized lending and borrowing.

How to Choose the Right DeFi Lending Platform?

Among the many top DeFi lending platforms in the crypto market, choosing the right one doesn’t have to be difficult. By following a few key criteria, you can easily identify the top DeFi lending platform for your lending or borrowing needs. Some of these criteria include:

- Security – Ensure that their smart contracts have been audited and that strong protocols for risk management are followed by the platform.

- Asset Setting – A choice between several options of collateral and loan tokens might be a much-needed flexibility for you.

- Interest Rates & Fees – A fair and transparent fee structure might mean better returns or higher costs for funding.

- User Experience – An easy-to-use user interface design and a straightforward wallet integration would help with accessibility and adoption by newer users.

- Liquidity & Volume – Larger liquidity pools lead to better loans, while rates enjoy stability.

- Innovation Factor – Platforms that incorporate flash loans, multi-chain operations, or yield optimization rank higher.

- Community & Governance Setup – Likewise, strong communities, empowered by decentralized governance, would be pondering on the sustenance of the platform.

These are the basic considerations that will guide you to those platforms that suit your needs. Now that you know what to look for, enter the top DeFi lending Trends for 2026.

DeFi Lending Trends for 2026 and Beyond

DeFi lending in 2026 is shifting from a simple borrow-and-lend model to a capital-efficient process. Presently, the DeFi protocols are focusing on the modular lending markets that allow customized vaults, isolated risk pools, and interest modules. Also, stable-coin-centric protocols will dominate the competitive landscape, driven by predictable yield features.

- Cross-chain Lending – In the upcoming years, cross-chain lending processes are expected to flourish across multiple blockchain networks. The protocols help to unlock liquidity between varied ecosystems.

- AI-powered features – The on-chain and off-chain data are monitored by AI-driven features for an enhanced experience. The borrowers are no longer bound by over-collateralization.

- Regulated Protocols – Clear frameworks help to protect the users without killing the composability.

The prospects are obviously promising, as these very trends take DeFi lending closer to mainstream global finance.

Get your secure, scalable DeFi lending solution from Coinsclone

Cost-effective, White-Label Solution, Premium Features, Customizable. Live Demo Available.

Why Should You Choose Coinsclone for a DeFi Lending Platform?

Coinsclone is a leading Defi lending and borrowing platform development company offering the best DeFi development services and white-label solutions. With our ready-made software, we help startups to create their own DeFi platforms with enriched features. Our developer team has years of experience in creating DeFi lending platforms that align with the startup’s business goals and vision.

We offer specialized guidance in creating DeFi lending platforms to grab the attention of global users. We offer comprehensive solutions to build a user-centric DeFi lending platform. Our development team is top-notch at offering cutting-edge, reliable, and scalable DeFi solutions at an affordable cost. Connect with our business team today to get your personalized DeFi platform module!

Frequently Asked Questions

1. How does DeFi lending differ from traditional lending?

The DeFi lending platforms are decentralized protocols that allow people to lend and borrow digital assets without any intermediaries. The platform utilizes smart contracts to execute the lending process seamlessly.

2. How do DeFi lenders earn money?

The DeFi lenders of the platform can deposit crypto assets into the liquidity pools. Also, the borrowers can take out loans from these people to pay interest. The interest is shared among the lenders proportionally.

3. Do the DeFi borrowers need collateral?

Yes, in every DeFi lending platform, the borrowers must over-collateralize their loans that means locking up more value than they borrow. Some of the emerging protocols experiment with under-collateralization for user trust and credibility.

4. How are the DeFi lending interest rates determined?

The interest rates on the DeFi lending platforms are usually algorithmic. They rise when the demand for borrowing increases and fall when the supply grows. This organic rhythm keeps the market fluid and responsive.

5. Are DeFi lending platforms safe?

Of course. Yet, based on the protocols and the ecosystems, the probability of security varies. Always check for the blockchain, blockchain gas fees, study documentations, etc for trustworthy lending transactions.

Launch Your DeFi Lending Platform Faster With a Proven MVP System

Top DeFi Lending Platform Development — Built for Scale, Security, and Cost-Efficiency

- MVP System :Launch your top DeFi lending platform up to 90% faster.

- Real-Time Data Engine : Core lending logic, interest rate models, collateral management, and liquidation modules pre-integrated — no complex development required.

- Brand & Customization : Your assets, your collateral rules, your interest rates, your UI, your governance.

- Revenue Engine :Earn from lending interest spreads, borrowing fees, liquidation incentives, and protocol parameters.

Get a free branded demo of your DeFi lending platform MVP within 48 hours — before committing to development.

Book a free strategy call to see how our DeFi lending platform MVP can take you from idea to a live, production-ready protocol in as little as 2–4 weeks.