A wallet is typically used to store your money, right? But what if I told you this wallet could actually help you profit from the booming cryptocurrency fashion? Yes, you heard that right – crypto wallets are becoming one of the most talked-about businesses in the cryptocurrency market today. In fact, the global cryptocurrency wallet market size was valued at $5.69 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 23.5% from 2024 to 2030. While physical wallets store your money in the real world, crypto wallets serve different purposes in the digital world, each offering unique functions and benefits.

With so many options available, it’s important to understand their differences and how they can fit into your strategy. To help you gain a deeper understanding, this blog will guide you via the world of digital wallets, shedding light on their roles, types of crypto wallets, and benefits in the cryptocurrency space.

See How Our MVP System Can Help You Build the Right Type of Crypto Wallet Faster

Crypto Wallet Development — done right.

-

MVP System : Create custodial or non-custodial crypto wallets 90% faster.

-

Pre-Built Modules : Private key management, multi-chain access, and secure storage—no coding needed.

-

Brand & Customization : Your design, your blockchain, your control.

-

Revenue Engine : Earn from transaction fees, swaps, and staking—no matter which wallet model you choose.

Get a free branded demo of both custodial and non-custodial wallet types in 48 hours — before you invest a cent.

Book a Free Demo to discover how our system helps you choose, build, and launch the perfect wallet — Custodial or Non-Custodial — in just 2–4 weeks.

What is a Custodial Wallet?

A Custodial wallet is a type of cryptocurrency wallet where a third-party service, like an exchange or a platform, manages your private keys more securely. With the custodial wallet, users do not have full control over their funds, since the wallet provider has all the custody of the private keys. However, since the third party has control, you rely on their security measures to keep your funds safe. So if the platform is hacked by any chance, your funds could be at risk. Custodial wallets are ideal for beginners and for those who value ease of use and are comfortable trusting a service provider to handle their crypto assets.

Key traits of custodial wallets:

-

The platform manages your private keys.

-

Easy recovery if you forget your password.

-

Suitable for beginners or traders using centralized exchanges.

Example Platforms – Binance, Coinbase, and Kraken offer custodial wallets. These wallets allow users to store, send, and receive cryptocurrencies without worrying about private keys or technical complexities.

What is a Non-Custodial Wallet?

A Non-custodial wallet is another type of cryptocurrency wallet where the user has complete control over their private keys and also their funds. These wallets do not involve third-party interference, thus offering more security and privacy. Only users are responsible for securing the keys via a seed phrase ( A unique set of 12 to 24 words that acts as a backup to access and recover a non-custodial wallet and its funds). In case you have lost the private keys or forgotten them, then the funds cannot be recovered. These wallets are popular among experienced users and for those who want full control of their digital assets and prioritize robust security.

Key traits of non-custodial wallets:

-

You hold your private keys and seed phrases.

-

No middleman, complete independence.

-

Ideal for privacy-conscious and advanced users.

Popular non-custodial wallets – MetaMask, Trust Wallet, and Ledger (hardware wallets). This non-custodial wallet allows you to trade, send, or store cryptos without relying on an intermediary.

Curious about what sets these wallets apart?

Difference Between Custodial and Non-Custodial Wallets

Understanding the key differences between custodial and non-custodial wallets is the only way to decide which one fits your needs best. Let’s explore the differences between custodial and non-custodial wallets to strike the perfect balance,

| Features | Custodial Wallet | Non-Custodial Wallet |

| Private Key Ownership | The Private keys here are managed by third-party services. | The platform users have control over the private keys. |

| Security Protocols | The wallet is responsible for securing funds. Users may face the risks of hacks. | The users handle the private keys and are responsible for securing wallets. |

| User Experience | User-friendly and designed for easy trading, especially for beginners. | Users would require more technical understanding. |

| Recovery Options | Comes with recovery options like email support, which can retain information. | If the keys or seed phrases are lost, there is no way to recover the funds. |

| Privacy & Autonomy | Users have limited privacy, as the platform can access transaction data. | Offers full privacy and autonomy, as no third party can access your wallet. |

| Ideal For | Crypto New Users, Compliance Heavy Apps | DeFi Platforms, Professional or Pro-traders |

| Example | Coinbase Wallet, FreeWallet | MetaMask, Exodus |

With this differentiation laid down, the confusion of choosing between these might only have tightened. So, to help you choose better, let’s view the pros and cons of each of these crypto wallets. Let’s start with analysing the benefits and limitations of the custodial wallets.

Pros and Cons of Custodial Wallet

The custodial cryptocurrency wallets have numerous characteristics and have both advantages and disadvantages.

Pros of Custodial Crypto Wallets

- Seamless Integration with Ecosystems: Many custodial wallets are part of larger ecosystems, so this enables users to trade, invest, and transfer funds without leaving the platform. Every aspect of the crypto is connected and maintained under one roof, making crypto management easier.

- Multi-Asset Support: Custodial wallets often support a wide range of cryptocurrencies. Instead of handling several wallets for different coins, users can manage their entire portfolio in one place. Besides, as the login here is via credentials, users can sync accounts easily.

- Regulatory Compliance: One of the key advantages of these wallets is their adherence to regulations. For those unsure of how to create a crypto wallet that meets local regulatory requirements, these wallets handle legal and regulatory considerations on behalf of the user.

- Transaction Speed: Another notable perk is the transaction speed. If it is within the same platform, then they are often faster, as they don’t require blockchain confirmations. This saves time for users who are looking to make frequent trades or transfers.

- Access to Advanced Features: Some custodial wallets provide features like margin trading, lending, or fiat on/off ramps. This showcases their high versatility. Some custodial wallets go beyond simple storage. They offer features like lending, margin trading, or fiat gateways, catering to both beginners and advanced traders.

Cons of Custodial Crypto Wallets

- Shared Control of Funds: One of the major disadvantages is that the provider secures the funds here. So, the users may experience limitations in accessing their crypto during any security checks or compliance procedures. Besides, this shared control increases dependency on the provider’s internal policies.

- Platform Dependency: If the service provider discontinues its wallet or changes its terms, users are the ones who might face disruptions or need to migrate funds. This also signifies that users are fully reliant on the provider’s system updates and performance. So, any downtime or technical glitch would directly affect the fund accessibility.

- Hidden Costs: Some of the custodial wallets charge hidden fees for transactions or withdrawals. This factor will surely increase the cost of usage. In addition, some wallets may levy conversion charges, maintenance fees, or network-related costs on the project flow.

- Limited Customization: Basically, custodial wallets top in ease-of-use. But they have the drawback of not letting users alter any wallet functionality or security protocols since the provider controls the framework. Advanced users or developers cannot integrate any advanced features, making it less appealing.

- Geo-Restrictions: In speaking of worldwide, certain custodial wallets may not be available in all regions, limiting access based on location. Users in restricted countries might face blocked access, delayed services, or a complete inability to sign up, reducing global adoption.

Now, with this comparison, let’s move on to the other side,

Pros and Cons of Non-Custodial Wallet

Pros of Non-Custodial Crypto Wallets

- Full Control: Non-custodial wallets give users absolute ownership of their funds and private keys. This will be the ultimate advantage since users are not required to have third-party interference. This independence makes the non-custodial wallets highly trusted among crypto enthusiasts.

- Enhanced Security: As private keys are stored locally and not on centralized servers, these non-custodial wallets reduce the risk of large-scale hacks. Even if an exchange or the wallet provider is breached, your funds will remain unaffected. This makes them the best option for long-term storage.

- Cross-Platform Compatibility: These wallets often support integration with decentralized apps (dApps), DeFi platforms, and NFT marketplaces. So this will be another advantage of offering flexibility. This interoperability allows users to trade, stake, lend, and interact with Web3 ecosystems directly from their wallets.

- Crypto Trends: As the popularity of decentralized finance (DeFi) and blockchain-based applications grows, non-custodial wallets are becoming increasingly important. This makes them stay with the latest cryptocurrency trends. They allow users to participate in liquidity pools, yield farming, and NFT trading.

- Global Accessibility: Non-custodial wallets can be used anywhere in the world without restrictions. Users don’t want to rely on service providers’ policies or geo-restrictions. Since no central authority controls them, users in restricted countries can still enjoy seamless access.

- No Hidden Fees: Opting for a non-custodial wallet, users only pay transaction fees to the blockchain network. Unlike custodial wallets, there are no extra or hidden charges imposed by service providers. This makes them a cost-effective option for frequent crypto users.

- Backup and Recovery Options: With seed phrases, users can easily back up and recover their wallets on any compatible device. This ensures that even if a phone or computer is lost, access to funds remains safe and recoverable. These wallets will also keep the seed phrase secure.

- Privacy Focused: Adding to the above, these wallets allow users to maintain complete anonymity. These wallets don’t require personal details like KYC or identity verification for access. This focus on privacy allows users to transact anonymously with great financial freedom.

Cons of Non-Custodial Crypto Wallets

- Steep Learning Curve: Beginners might find non-custodial wallets intimidating due to the responsibility of managing private keys and seed phrases. Without proper knowledge, even simple tasks like sending crypto can feel risky. This makes them more suited for pro-traders and less beginner-friendly.

- Risk of Loss: The biggest disadvantage is losing private keys or seed phrases. This means permanent loss of funds, as there’s no way to recover access. Since there is no central authority or recovery options, mistakes made here are irreversible. This creates high stakes for every user.

- Limited Customer Support: Unlike custodial wallets, non-custodial wallets don’t offer dedicated support. This factor may cause the users to troubleshoot issues independently without any support. Any errors, bugs, or transaction failures must be resolved independently, which can frustrate less tech-savvy users.

- Device Dependency: If a device storing the wallet is lost or compromised, funds will be at risk unless securely backed up. However, you can skip these if you’ve properly backed up your seed phrase. This dependency on personal devices adds another layer of responsibility to wallet management.

- No Direct Fiat Integration: Unlike custodial wallets, most of the non-custodial wallets don’t support direct fiat-to-crypto transactions. They require third-party services for conversions. These steps add up extra steps, potential fees, and sometimes result in hectic delays.

- Time-Intensive: Another drawback is that the users must manually verify transaction details and gas fees, which can be overwhelming for frequent traders. For frequent traders, this can slow down the trading experience compared to one-click custodial wallets.

- Security Responsibility: When it comes to security, the way of protecting funds lies entirely with the user. This requires strong passwords and secure storage of keys. Strong passwords, secure seed storage, and careful device management are mandatory. A small lapse can lead to permanent losses.

With these pros and cons are there, you will be confused about which of them would suit your business requirements, right?

While both the custodial and non-custodial wallets are unique and have their own set of properties and limitations, choosing them for your own business requirements is a must. So, now let’s see,

Which Type of Crypto Wallet is Best Suited For Your Business?

When comparing custodial and non-custodial wallets, both properties and perspectives might be the same. But in business terms, the difference lies in control, security, and responsibility. Custodial wallets offer convenience but place your assets in the hands of a third party. This means you trade independently at your own ease. Also, in contrast, the Non-custodial wallets, on the other hand, the wallets will not hold out the keys. The users here are completely responsible for those keys. This gives businesses full ownership of their digital assets.

Let’s make this simple for you. Choosing between custodial and non-custodial crypto wallets depends on who your users are and what your business stands for.

Let’s break down what fits best for different business types.

| Business Type | Recommended Wallet Type | Why It Works |

|---|---|---|

| Crypto Exchanges | Custodial Wallet | Offers easy onboarding, recovery options, and centralized control — perfect for fast-moving traders. |

| DeFi Projects | Non-Custodial Wallet | True decentralization where users own their keys, boosting transparency and user trust. |

| NFT Marketplaces | Hybrid / Non-Custodial Wallet | Enables NFT minting, buying, and selling while letting users retain asset control. |

| Payment Platforms | Custodial Wallet | Ensures smoother transactions and better compliance for regulated financial ecosystems. |

This is why non-custodial crypto wallet development is popular among businesses. They stand out as the unique choice. These may require heavy responsibility, but in return, they offer control, trust, and long-term security. The smartest crypto startups combine both worlds by building hybrid cryptocurrency wallet systems that let users toggle between centralized convenience and decentralized control. That’s exactly where modern crypto adoption is headed: user choice with built-in trust.

With this, let’s take a look at some of the most popular crypto wallets that businesses worldwide are already using.

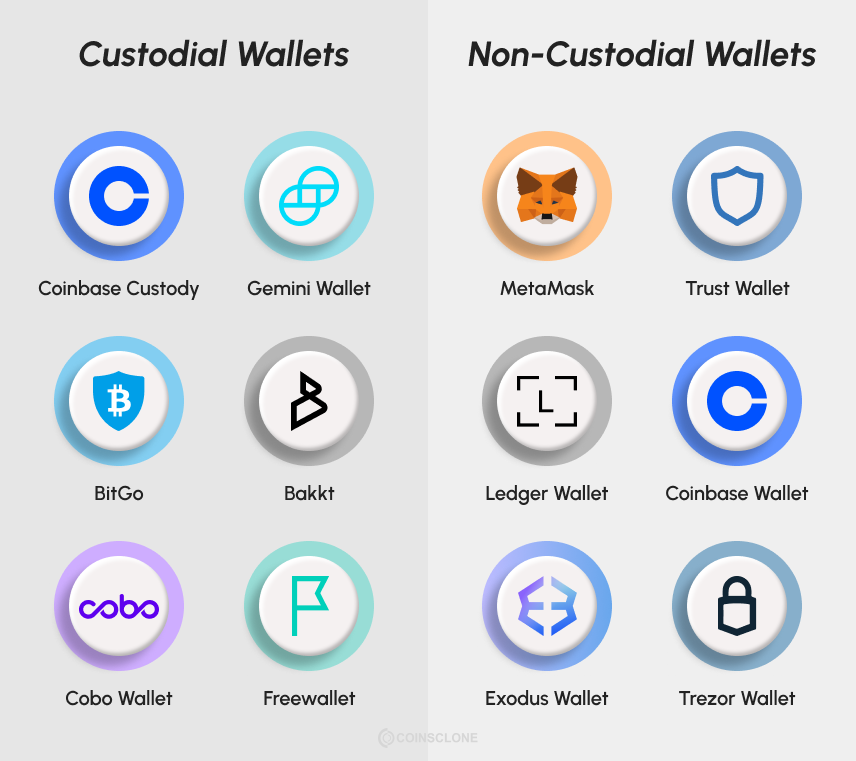

Best Custodial Wallets And Non-Custodial Wallets

Businesses and individuals now look for features like multi-chain compatibility, NFT storage, staking options, built-in swaps, and dApp integration. Besides these features, security protocols are also a top priority. Now that you understand what each type offers, let’s explore some of the leading crypto wallets in both categories. Here’s a list of some of the most reliable and widely popular cryptocurrency wallets to know,

Top Custodial Crypto Wallets

🔹 Binance Wallet – The powerhouse for crypto traders. It merges trading, staking, and secure storage. All under Binance’s multi-layered security infrastructure. Great for users who value simplicity and speed.

🔹 Coinbase Wallet (Exchange) – Known for its user-first design for beginners. It’s ideal for beginners who want a regulated environment with reliable fund protection, 2FA, and insured storage.

🔹 Kraken Wallet – Known for institutional-grade reliability. The Kraken Wallet offers regulatory compliance, cold storage options, and an impeccable record of security. Ideal for serious investors and exchanges.

Top Non-Custodial Crypto Wallets

🔹 MetaMask – The gateway to Web3. MetaMask empowers users to interact directly with decentralized apps (dApps) and DeFi platforms and DEX.

🔹 Trust Wallet – A versatile, mobile-friendly option supporting 65+ blockchains. With private key control and a built-in DEX, it’s the go-to for users who demand full autonomy.

🔹 Exodus – A sleek, desktop and mobile wallet designed for simplicity. It supports over 250 assets, includes built-in staking. It empowers users to manage their crypto portfolio securely without intermediaries.

If you’re building a crypto exchange or payment app, a custodial wallet ensures accessibility and compliance. If your product focuses on DeFi, NFT trading, or user empowerment, a non-custodial or hybrid crypto wallet delivers the decentralization edge modern users expect.

And if you want to build either (or both), Coinsclone’s Cryptocurrency Wallet Development Services can help you design a cryptocurrency wallet ecosystem tailored to your business model.

Final Thoughts

By this time, you will have a better understanding of the different types of crypto wallets, so you’re now ready to take the next step to build one. The best way to go about this is by partnering with a trusted crypto wallet development company that can tailor a solution to meet your specific business needs.

Coinsclone is a standout in the field, offering a range of blockchain development services, with expertise in cryptocurrency wallet creation. Reach out to us today and experience our development process firsthand with a free trial, giving you a clear understanding of how we can bring your ideas to execution.

FAQs

1. What are the primary differences between custodial and non-custodial wallets?

Custodial wallets store your private keys with a service provider, while non-custodial wallets let you control your keys yourself.

2. How does a custodial wallet work?

In a custodial wallet, a service provider will be securing your funds and private keys. So this will make it easy for you to recover your account but at the same time, it will reduce your control.

3. What is a non-custodial wallet, and why is it important?

A non-custodial wallet lets users fully manage their private keys and funds. It is an important one since it offers great autonomy and eliminates reliance on third parties.

4. Which is better: custodial or non-custodial wallets?

If you take custodial wallets, it offers convenience and backup support, whereas if you go for non-custodial wallets, it provides better security and control. So choosing between these two wallets is purely based on your business requirements.Yes, many cryptocurrency wallet development companies (like Coinsclone) create hybrid crypto wallet solutions to balance control and convenience.

5. Are non-custodial wallets more secure than custodial wallets?

Non-custodial wallets are more secure against any kind of breaches since only you hold the keys, but they require careful management to avoid loss.

See How Our MVP System Can Help You Build the Right Type of Crypto Wallet Faster

Crypto Wallet Development — done right.

-

MVP System : Create custodial or non-custodial crypto wallets 90% faster.

-

Pre-Built Modules : Private key management, multi-chain access, and secure storage—no coding needed.

-

Brand & Customization : Your design, your blockchain, your control.

-

Revenue Engine : Earn from transaction fees, swaps, and staking—no matter which wallet model you choose.

Get a free branded demo of both custodial and non-custodial wallet types in 48 hours — before you invest a cent.

Book a Free Demo to discover how our system helps you choose, build, and launch the perfect wallet — Custodial or Non-Custodial — in just 2–4 weeks.