Cryptocurrency exchanges have become one of the most profitable ventures in today’s digital financial world. As the adoption of crypto continues to grow globally, many entrepreneurs and investors are asking the same question — how do crypto exchanges make money?

The answer goes far beyond simple trading fees. While trading and transaction fees remain the most common and visible income sources, successful crypto exchanges use multiple revenue streams to maximize profitability. For startups and businesses looking to build their own crypto exchange platform, understanding these different ways to generate revenue is critical.

A well-structured revenue model not only ensures steady income but also helps your exchange stand out in a highly competitive ecosystem. In this guide, we’ll break down the various ways cryptocurrency exchanges make money — from traditional trading fees to innovative business models that are reshaping the future of digital finance.

How Do Crypto Exchanges Make Money?

Build your own exchange and tap into these revenue streams — faster than you think.

- Trading Fees : Every buy, sell, and swap earns commissions.

- Staking & Yield : Earn from users locking up assets on your platform.

- Spread & Liquidity : Profit from market-making and liquidity provision.

- Premium Features : White-label services, VIP tiers, and more.

Our MVP Exchange System helps you launch 90% faster — complete with wallets, liquidity, and revenue modules.

Book a Free Demo to see how you can launch your branded crypto exchange in just 2–4 weeks — and start earning from Day 1.

Understanding the Crypto Exchange Business Model

A cryptocurrency exchange is a digital marketplace that allows users to buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, or stablecoins. The exchange acts as an intermediary, connecting buyers and sellers, matching orders, and earning revenue from each transaction or service it facilitates. There are mainly two types of crypto exchanges: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX).

- Centralized exchanges such as Binance, Coinbase, or Kraken operate like traditional stock markets. They manage user accounts, store funds, and handle transactions on behalf of users. In return, they charge trading fees, listing fees, and other service-based charges.

- Decentralized exchanges, on the other hand, work through smart contracts on blockchain networks. These platforms don’t hold user funds directly but still generate revenue through liquidity pool fees, governance tokens, and protocol-based charges.

The business model of a crypto exchange revolves around transaction volume, liquidity, and user activity. The more users trade, the more the platform earns. In addition to trading fees, exchanges also diversify revenue through various products including margin trading, staking, and lending to create multiple income channels.

For startups, creating a crypto exchange is not just about launching a platform but developing a sustainable profit model. So, let’s dive into…

How Do Crypto Exchanges Make Money in 2026?

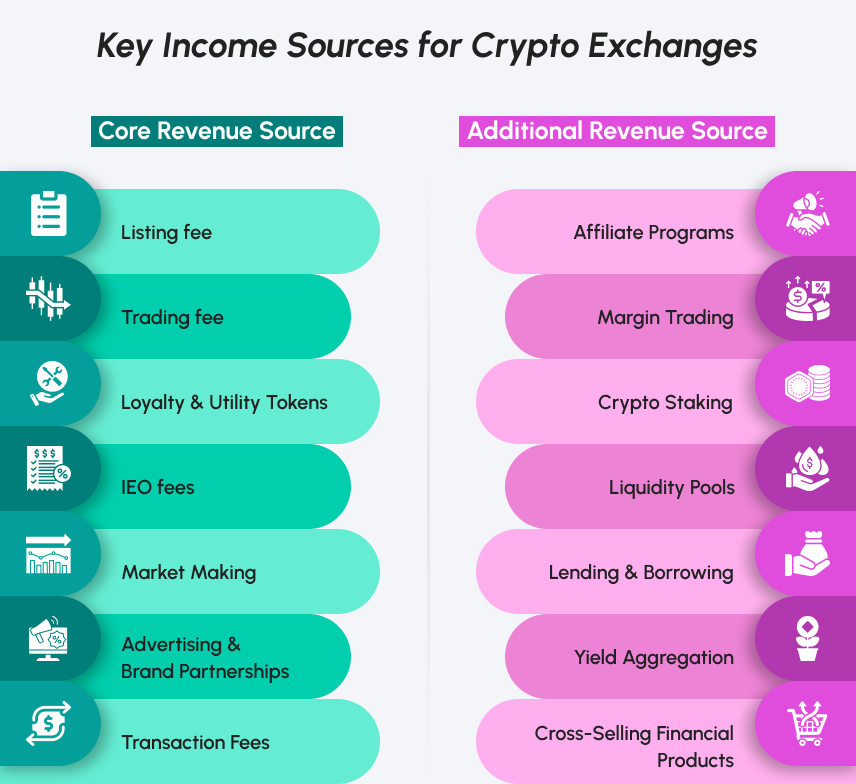

For a crypto newbie or startup, understanding how exchanges earn, manage liquidity, and control operational costs is key to long-term success. Here is the main streams of revenue from which crypto exchanges make money:

- Listing fee

- Trading fee

- Loyalty & Utility Tokens

- IEO fees

- Market Making

- Advertising & Brand Partnerships

- Transaction Fees

Listing Fees

This is one such added advantage of starting a cryptocurrency exchange. If you run a cryptocurrency exchange, many companies will want to list their tokens, providing you with significant revenue each time they do so.

For that to happen, you should have an acceptable level of user base. In which the token owner would consider that putting the token in your exchange platform. So, that it is helpful to earn some users and traders for their token or coin.

Trading Fee

The trading fee is different from that of the transaction fee. This is calculated based on the trading options that the trader opts for. If you want to go by derivatives trading, then it will attract a different fee and if you want to go by OTC trading, the trading fee would differ.

The thing is it differs based on the amount of transaction that one wants to put in the trade and the value of the trade. Therefore, running a derivative-based cryptocurrency exchange can generate significant trading fee revenue with a decent user base.

Loyalty & Utility Tokens

This is the new feature that the exchange operators are using in their respective exchange platforms. Also, it is a token to keep the users in a parallel fee structure. The purpose of the token is to provide offers and rewards to users.

These rewards are given when users utilize the token to pay fees or conduct transactions on the exchange platform. Moreover, it increases the revenue of the cryptocurrency exchange and keeps your users on track so that they do not miss out on your crypto exchange platform.

IEO Fees

It is common for leading cryptocurrency exchange development companies to offer an Initial Exchange Offering (IEO) launchpad as part of their services. Also, this is beneficial for entrepreneurs who want to introduce a new coin through your exchange platform.

These entrepreneurs are often willing to pay a significant fee to have their IEO listed on your platform. By facilitating their IEO, you can earn a portion of the tokens or a share of the profits, depending on what you negotiate. Moreover, the more sales you make, the greater your revenue potential.

Market Making

It is similar to marketing the token or coin. Market Makinig is like adding value to the cryptocurrency based on the market they have. Also, it is like buying a token or a coin at the lowest price in the initial level and selling them for higher prices when the prices go up.

This can help the users and traders to analyze the importance of the coin or a token. Also, you can also introduce a particular contest for a particular token or a coin. Then you can announce cash prizes for that particular token or a coin holder in large amounts.

Advertising & Brand Partnerships

Cryptocurrency exchanges can create premium ad spaces or special sections for advertisers who pay more, which can increase revenue even further. By matching ads with the interests of their users, exchanges can establish a reliable and growing source of income.

Additionally, Exchange platforms can display ads using services like Google AdSense or make direct deals with advertisers. The ads can be targeted to users with relevant offers, using the platform’s traffic to generate significant income.

Transaction Fees

Transaction fees are a primary and reliable source of income for cryptocurrency exchanges. A small percentage is charged on every trade or transaction, creating a steady revenue flow as trading activity increases. Also, this method aligns with the platform’s volume, meaning the more active the users, the higher the earnings.

Exchanges often implement tiered transaction fees, rewarding high-volume traders with discounts while encouraging more trading. And this ensures consistent income while promoting user loyalty and engagement.

Apart from these, many other opportunities can help maximize the profitability of a cryptocurrency exchange business by diversifying income streams and strengthening the overall business model. Also, this will help you to create a proper plan for crypto exchange business to kickstart with. These are the primary sources of income in the crypto exchange. Now, let’s move on to…

Additional Revenue from Creating a Crypto Exchange Platform

Creating a cryptocurrency exchange app opens up multiple avenues for generating revenue beyond just trading fees. With the rise of digital assets and the increasing demand for crypto-related services, exchanges can diversify their income streams in various ways. Below are some of the key additional revenue opportunities for cryptocurrency exchange platforms.

Affiliate Programs

Affiliate programs allow cryptocurrency exchanges to generate additional revenue by partnering with influencers, bloggers, or other platforms. Also, affiliates promote the exchange to their audience, and in return, they earn a commission for every user who signs up and trades. Moreover, this helps expand the user base while rewarding affiliates for bringing in new traders, creating a win-win situation for both parties.

Margin Trading

Margin trading lets users borrow funds to increase their position size in trades. Exchanges can charge interest on these borrowed funds, creating a continuous stream of income. This type of trading often attracts higher volumes, especially in volatile markets, and can be highly profitable for exchanges, especially if they offer leverage on various cryptocurrency pairs.

Crypto Staking

Crypto staking allows users to lock their cryptocurrencies in the exchange to help maintain the network and earn staking rewards. The exchange can charge a fee on the rewards earned by users. This service provides a passive income option for users and generates a steady revenue stream for the platform, as more users participate in staking.

Liquidity Pools

Exchanges can create or participate in liquidity pools, where users contribute funds to facilitate decentralized trading. In return, liquidity providers earn a share of the trading fees generated by the pool. The exchange may also charge a fee for facilitating these pools, making it a profitable venture while ensuring liquidity on the platform.

Lending & Borrowing

Lending and borrowing services allow users to lend their crypto for interest or borrow funds by providing collateral. The exchange can charge fees on both lending and borrowing transactions. This creates a consistent revenue source while offering users the ability to earn passive income or access leverage on their digital assets.

Yield Aggregation

Yield aggregation services allow users to automatically move their funds between different DeFi protocols to maximize returns. The exchange can charge a small fee for managing these funds and optimizing yields for users. This service adds value by helping users get the best possible returns on their assets, while also generating revenue for the platform.

Cross-Selling Financial Products

Crypto exchanges can partner with third-party financial institutions to offer products like loans, insurance, or retirement plans. By cross-selling these products, the exchange earns a commission or fee for each customer who signs up for these services. This diversifies the platform’s revenue sources and strengthens its role as a one-stop financial hub for users.

By integrating multiple income streams, exchanges can diversify their financial models and becomes a profitable exchange platform. To spice this up, here are the top revenue models of the crypto exchange platforms.

How Profitable is it to Run a Cryptocurrency Exchange?

Developing a crypto exchange can be profitable, primarily influenced by trading volume, fees, liquidity, and user base. Most exchanges charge trading fees ranging from 0.1% to 1%, with larger platforms often opting for lower fees to attract traders. High trading volumes can lead to significant profits, and additional services like advanced trading tools and margin trading can enhance revenue.

However, challenges such as regulatory issues, security risks, and fierce competition can affect profitability. Strong security measures are essential to maintain user trust, and compliance with regulations requires substantial investment. Despite these hurdles, the increasing interest in cryptocurrencies and advancements in blockchain make crypto exchanges an attractive business model. With effective user acquisition and efficient operations, a cryptocurrency exchange can be a lucrative venture.

So, if you’re looking to tap into this growing market and build your own successful cryptocurrency exchange, partnering with the right development company is key. Coinsclone is a top-notch cryptocurrency exchange development company renowned for creating secure, scalable, and feature-rich cryptocurrency exchange platforms that cater to the evolving market needs.

Why Coinsclone Is the Best Partner to Build Your Crypto Exchange?

Coinsclone offers end-to-end cryptocurrency exchange development solutions, from custom development to deployment. Also,ensuring that each exchange platform is tailored to meet the unique needs of our clients. Moreover, we provide cutting-edge technologies, robust security features, and seamless user experiences, all while ensuring compliance with global regulations.

Our reputation for delivering high-quality, cost-effective solutions has made us a trusted choice for entrepreneurs looking to enter the cryptocurrency market. With years of expertise in cryptocurrency exchange development, we ensure that our platforms meet the highest quality standards. Also, we also focus on delivering scalable and future-ready platforms equipped with essential features.

What truly sets Coinsclone apart is our commitment to quality and scalability. Whether you’re a startup looking for a white-label crypto exchange or an enterprise planning a custom-built trading ecosystem, our solutions are designed to grow with your business. We focus on delivering cost-effective, high-performance platforms that provide long-term reliability and competitive advantage. With the crypto market witnessing exponential growth and increasing adoption, there’s no better time to capitalize on this trend. Start your cryptocurrency exchange business now and secure your place in the future of digital finance.

Frequently Asked Questions:

1. How do crypto exchanges make money without charging fees?

Even if an exchange promotes “zero-fee trading,” it still earns through indirect revenue models. These include spreads between buy and sell prices, lending and staking services, token listings, and advertising partnerships. Some exchanges also offer premium memberships or promote their own native tokens, which generate additional income despite not charging direct trading fees.

2. How much does it cost to start a crypto exchange in 2026?

The cost to start a crypto exchange in 2026 depends on the type of platform, features, and compliance requirements. A basic white-label exchange may start around $15,000–$30,000, while a fully customized, enterprise-grade platform can range starts from $200,000. Costs also vary based on liquidity setup, security integrations, and legal licensing.

3. What is the average profit margin of a crypto exchange?

On average, a well-managed crypto exchange can achieve profit margins between 20% and 60%, depending on scale and market conditions. High-volume exchanges with efficient liquidity management often reach even higher margins. Profitability also depends on factors like fee structure, operating costs, and market volatility.

4. Which crypto exchange is the most profitable?

Centralized exchanges like Binance, Coinbase, and OKX remain the most profitable in the market due to massive trading volumes, diversified revenue models, and institutional partnerships. Their profitability comes from combining trading fees, futures markets, and ecosystem tokens, making them strong examples for startups aiming to scale in the crypto industry.

Related Resources

- How Do Coinbase Make Money

- Benefits of starting a cryptocurrency exchange

- How Long Does It Takes to Build a Crypto Exchange

How Do Crypto Exchanges Make Money?

Build your own exchange and tap into these revenue streams — faster than you think.

- Trading Fees : Every buy, sell, and swap earns commissions.

- Staking & Yield : Earn from users locking up assets on your platform.

- Spread & Liquidity : Profit from market-making and liquidity provision.

- Premium Features : White-label services, VIP tiers, and more.

Our MVP Exchange System helps you launch 90% faster — complete with wallets, liquidity, and revenue modules.

Book a Free Demo to see how you can launch your branded crypto exchange in just 2–4 weeks — and start earning from Day 1.