Do you know, as per the reports of Grand View Research, ‘The global decentralized market was valued at 3,405 million dollars in 2024, where it is expected to grow to 39,123 million dollars in 2030’. From this, it is evident that the global market has the potential.

Unlike centralized platforms, DEX platforms, which are backed by smart contracts, enable users to remain anonymous while trading crypto assets. These digital marketplaces rewrite the rules of cryptocurrency trading, eliminating middlemen and gatekeepers. This made way for more of the best decentralized exchange platforms to arise.

Among numerous platforms, choosing the best one will help you trade crypto assets efficiently. In this blog, we help you walk through the 10 best decentralized crypto exchange platforms of 2026 that blend freedom, transparency, and innovation. Let’s get through it.

See How Our MVP System Helps You Build the Best Decentralized Exchange

Best Decentralized Exchange — built for secure, fast, and trustless crypto trading.

- MVP System : Launch a scalable DEX with AMM, order book, or hybrid trading models.

- DeFi-Ready Modules : Integrate liquidity pools, multi-chain swaps, farming, staking, and wallets.

- Brand & Customization :Customize UI, trading pairs, fee structures, and governance.

- Revenue Engine : Generate revenue through swap fees, incentives, and premium features.

Get a free DEX strategy demo in just 48 hours — before development begins.

Book a Free Demo to launch the best decentralized exchange in 8–12 weeks and stay ahead of the market.

What is a Decentralized Exchange?

A decentralized exchange (DEX) is a blockchain-backed trading platform that enables users to buy, sell, stake, and lend cryptocurrencies. Without relying on intermediaries or centralized authorities, users can trade the digital assets directly between wallets. As the platforms are backed by smart contracts, the trade functions are automated, which ensures full custody, privacy, and transparency.

As the platforms are backed by smart contracts, the functioning of the DEX platforms is user-friendly. We have listed the overall working process of the best decentralized exchange platform in the next section.

How does a Decentralized Exchange work?

Instead of using a central authority to process transactions, DEX uses smart contracts to self-execute transactions on the blockchain. This means:

- No account setup is required – you trade directly from your crypto wallet.

- More privacy – no name and no identity verification.

- Full control – you own and control your funds at all times, minimizing hacking risks.

With developments in decentralized finance (DeFi), DEXs have stood unwaveringly at the very forefront of permissionless and secure trading. These leading decentralized exchanges in 2026 continue to offer excellent platform opportunities. Whether it is a low-fee trading, competitive incentive benefits, or inspiring startups to launch a new project, these best decentralized exchanges are for sure influencing. This is why traders often compare platforms to determine the best decentralized exchange that meets all their requirements.

With this, let’s get a bit deeper and see what features they possess,

Core Features of Decentralized Exchanges

Let’s get a quick once-over on the features that make the best decentralized exchanges optimal.

Must-have Features of DEX Platforms

Here is a list of some of the significant features that would determine the operational efficiency of your Decentralized Exchange Platforms.

- Smart Contract Integration

- Automated Market Makers (AMMs)

- Intuitive User and Admin Dashboards

- Essential API & Third Party Incorporations

- Robust Security Protocol

- Real-Time Analytical Tools

- Dispute Resolution System

- Liquidity& Price Setting Tools

- Governance Management

- Cross-Chain Compatibility

- Derivative Trading Features

- KYC/AML Requirements

- Wallet/Payment Gateway Integration

- Legal & Compliance Checks

Now, with all these features and functionalities, you may wonder what kind of beneficial potential these DEXs hold, right?

Benefits of Using a DEX Platform in 2026

Here is a little list of benefits that highlights the hidden potential of Decentralized Exchange platforms.

- Users gain full control over their assets, reducing the risk of hacks or security breaches.

- Trades are Peer to Peer mode, mostly carried out directly between users, eliminating the third-party intervention.

- The decentralized mode facilitates smooth transactions globally, transcending geographical restrictions.

- The core benefit of decentralization is the governance benefit. Users have complete governance, participating in the decision-making processes.

- Apart from trading benefits, traders can participate in staking or yield farming activities to earn additional incentives.

These benefits collectively define what users typically expect from the best decentralized exchange in today’s DeFi landscape. With this understanding, let’s explore the list of the best decentralized exchanges of 2026. These top DEXs are revolutionizing crypto trading and shaping the future of DeFi.

Challenges & Limitations of Using Decentralized Exchanges (2026)

While decentralized exchanges (DEXs) offer transparency and user control, they also come with certain challenges and limitations for users in 2026.

- One major issue is liquidity fragmentation, especially for new or low-volume tokens, which can lead to price volatility.

- User experience (UX) is another concern, as interacting with wallets, gas fees, and blockchain confirmations can feel complex for beginners.

- DEX platforms also depend heavily on smart contracts, and any vulnerability in the code can expose users to potential exploits or fund losses.

- Additionally, traders may face slippage, where the final trade price differs from the expected price due to market movement. In liquidity pool models,

- Providers also encounter impermanent loss, a temporary reduction in asset value caused by price fluctuations.

Understanding these risks is essential, before trading or launching a Decentralized Exchange Platform in 2026.

Best Decentralized Exchanges in 2026

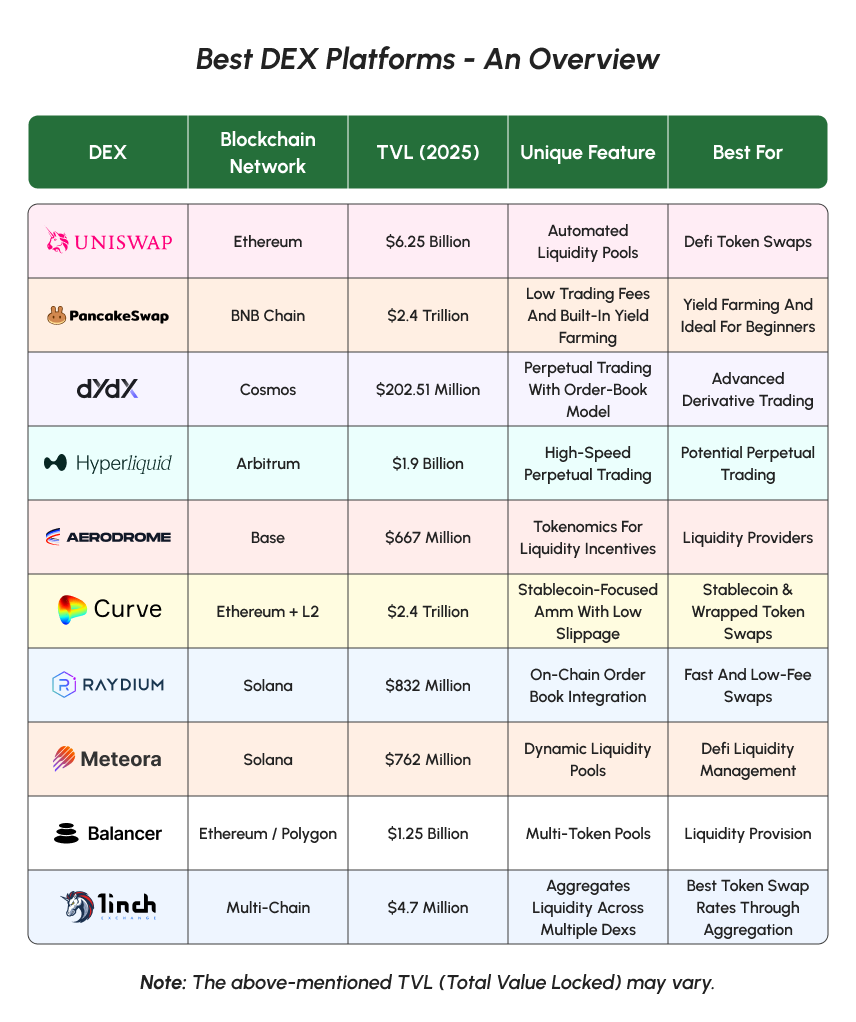

Presently, the decentralized exchange market is flooded with numerous decentralized exchange platforms. Among them, the best decentralized exchange can be chosen based on the trading volume, liquidity, security, etc. Here, we have listed the top 10 decentralized exchanges of 2026 to watch out for.

Uniswap

Ranking first among the best decentralized exchanges is Uniswap, built on Ethereum. It uses an Automated Market Maker (AMM) model, where users swap assets through liquidity pools instead of traditional order books. This DEX stands out for its innovative community-driven improvements, like advanced liquidity solutions and decentralized governance. Liquidity providers can also earn a share of trading fees, making it a profitable platform for both traders and investors. This success inspired many crypto startups to create a DEX like Uniswap, with similar AMM functionality and community-driven governance.

Key Features:

- DAO Governance: Managed by UNI token holders voting for upgrades of the protocol.

- V3 Concentrated Liquidity: Traders can provide liquidity in a specific price range for better capital efficiency.

- Multi-chain Expansion: It operates on Ethereum, Polygon, Arbitrum, and Optimism.

dYdX

A derivatives-oriented DEX that focuses on margin and perpetual trading, dYdX has become a stronghold for its professional traders. Advanced trading features available on the platform bring users looking for high trading volume, deep liquidity, and low-latency execution. Its professional-grade tools position it among the best decentralized exchange platforms for derivatives traders.

Key Features:

- High Trading Volume: Processes (24h) daily trading volume totaling over $134.44 million.

- Zero Gas Fees: Any transactions are settled off-chain using StarkWare’s Layer 2 solution.

- Highly Advanced Trading Tools: Limit orders, leverage trading, and perpetual contracts are all supported.

PancakeSwap

PancakeSwap is a decentralized exchange (DEX) on the BNB Chain, known for its fast transactions, low fees, and one-click trade confirmations. It is well known for its yield farming and staking benefits. The user-friendly interface makes it a popular choice among new traders. The platform allows users to stake tokens, swap assets, and earn passive income through rewards and incentives. With its rapidly growing ecosystem, PancakeSwap remains a key player in DeFi innovation. For entrepreneurs looking to build a similar platform, a PancakeSwap clone script offers a ready-made solution to launch your own DEX with essential features and functionalities. Its simplicity and speed make it a top contender for the best decentralized exchange in the BNB ecosystem.

Key Features:

- Low Fees: Transaction fees are low compared to Ethereum-based DEXs.

- Yield Farming: Users can stake liquidity provider (LP) tokens to earn CAKE rewards.

- NFT Marketplace: Trading and minting of NFTs on the BNB Chain are supported.

Hyperliquid (Arbitrum)

Hyperliquid is an Arbitrum-backed decentralized exchange that is designed for high-performance perpetual futures trading. With 40X leverage, the platform users can execute the trading efficiently. Also, the platform is highly known for its low and zero gas fees for all types of order trading. Hyperliquid clone script utilizes an on-chain order book for trading that improves price discovery. Traders seeking lightning-fast execution often consider Hyperliquid as the best decentralized exchange for leveraged trading.

Key Features

- Low latency – The platform’s Layer-1 architecture supports the very high throughput with sub-second finality.

- Perpetual Futures trading – Hyperliquid supports leveraged trades on various assets as well as spot markets.

- Cross-chain – The protocol allows deposits from Arbitrum and uses USDC on Arbitrum as a base collateral.

1inch Exchange

A DEX that is an aggregator to find the best trade rates amongst over 200 liquidity sources and optimize swaps for users is often referred to as the best DEX aggregator. 1inch Exchange helps traders achieve cost-effective trading at the best prices and with the utmost slippage. It uses smart contracts to layer trades among multiple exchanges efficiently, and it has now further extended its cross-chain capabilities for an even superior trading experience.

Key Features:

- No platform fees: Users pay only gas fees, making trades cost-effective.

- Smart Order Routing: Orders get split across multiple DEXs to minimize slippage.

- Multi-Chain compatible: Supported on Ethereum, Binance Smart Chain, and Polygon.

Aerodrome Finance

The Aerodrom Finance is one of the popular decentralized exchange platforms built on the Base blockchain network, which acts as a foundational liquidity layer. The platform utilizes AMM mechanics for innovative ‘vote-lock’ governance and emission models to incentivize long-term participation. Users can lock the protocol’s native token $AERO to receive veAERO that grants governance rights and a share of protocol fees. With the Base blockchain network, the platform offers efficient on-chain trading and liquidity services.

Key Features

- Rewards – The platform emphasises that all the swap fees and incentives flow back to users.

- Deep Liquidity – By combining the concentrated liquidity pool designs and optimized AMM structures, the platforms offer efficient liquidity for trading.

Balancer

An Ethereum-based DEX that allows users to customize their liquidity pools. The liquidity pool is highly popular among DeFi investors with a need for active portfolio management. Balancer clone script allows users to earn fees while still rebalancing their portfolios.

Key Features:

- Gas Fees for Trades: Cost-efficient Layer 2 solutions.

- Smart Liquidity Management: Multi-asset liquidity pools.

- Automatic Rebalancing of Portfolio: Traders can dynamically optimize the asset distribution.

Raydium (Solana)

Raydium is becoming a leading decentralized exchange platform that is backed by the Solana blockchain network. With the Solana blockchain, the platform offers both speed and low fees. Also, the platform ensures to offer a ‘Hybrid liquidity’ model for AMM pools and on-chain order books. Through this, the platform users can benefit from deep liquidity, faster settlement, and lower slippage.

Key Features

- Low-cost Transactions – As the platform is built on the Solana blockchain, it supports high throughput and low gas fees.

- Permissionless Pool – Users can create liquidity pools for any SPL tokens that enable yield-farming, staking, and also launch projects.

- Launchpad – Raydium doesn’t just offer swapping and farming, but it also supports new features.

Curve Finance

The leading DEX for stablecoin swaps, Curve Finance, provides deep liquidity and low slippage. Curve’s efficient swap function minimizes price impact on large trades. It is one of the most trusted platforms in the stablecoin sector. They are designed for stablecoin transactions. Cryptopreneurs could use a Curve Finance Clone to build a similar, reliable, and potential platform like Curve Finance.

Key Features:

- Stablecoin Focused: Optimized for assets like USDC, USDT, and DAI.

- $2B+ Total Value Locked: Provides high liquidity and efficient trades.

- Minimal Price Impact: Most appropriate for high-volume stablecoin transactions.

Meteora

Meteora is a liquidity-layer protocol and decentralized exchange built on the Solana blockchain. The platform is designed to provide advanced infrastructure for token swaps, yield strategies, and liquidity provisioning.

Key Features

- Dynamic Liquidity pools – These pools allow liquidity to be concentrated in specific price bins, reducing slippage.

- Solana Ecosystem – Meteora serves as a backbone liquidity layer for many Solana DeFi protocols and takes advantage of Solana’s high throughput.

- Token Utility – The native token MET is planned for a Token Generation Event and will enable governance, incentive distribution, and participation.

These best Decentralized Exchanges that offer secure trading in the evolving DeFi landscape. As KYC has become a hassle, many DEXs took this opportunity to their advantage and became the best non-KYC crypto exchanges.

As DeFi grows, building a DEX offers a strong advantage, but….

Why Should We Build a Decentralized Exchange?

With today’s fast-evolving Web3 advancements, building a top decentralized exchange is a strategic business opportunity. According to DefiLlama, DeFi’s total value locked(TVL) alone sums up more than $ 110 billion as of early 2025. And, DEXs are the growing share that powers and backs up this stat value. This strongly highlights how traders are shifting to more secure, private, and transparent trading volumes.

But what does it mean for enthusiastic startups and businesses?

Definitely a golden opportunity! Just think about the odds of launching your own Decentralized Exchange platform.

You can easily tap into a revenue-rich and innovative business model. Aside from the community business benefits, a Decentralized Exchange Development gives you stable profit-making opportunities. You can earn by levying trading fees, Token listing fees, token sales, incentives, and other strategic money-making ways.

Even a moderately active DEX can yield millions in monthly revenue. Platforms like Aave and Lido are making a live 24h revenue of above $200+. More importantly, DEX platforms give full control to users, reducing custodial risks. a major factor behind their popularity. This level of user control is one of the main reasons traders actively search for the best decentralized exchange.

So, how do you bring this idea to life?

This is where Coinsclone comes in,

Why Choose Coinsclone for the Best Decentralized Exchange Development?

Whether you’re a startup ready to step in or a business looking to expand your potential, our expert team offers complete DEX development services. Coinsclone is a leading decentralized exchange Development company, offering businesses a seamless way to enter the DeFi market.

Besides, our White-label DEX solutions are a cost-effective alternative for businesses with budgetary requirements. These ready-made platforms, with pre-built features, can be deployed quickly with minimal development costs. As DEX technology continues to evolve, Coinsclone stays ahead of industry trends, delivering transparent and efficient trading solutions.

Frequently Asked Questions

1. Which is the Cheapest Decentralized Exchange?

In 2026, the cheapest decentralized exchange depends on your network: Jupiter is the lowest-cost option for Solana users with near-zero gas, while PancakeSwap v4 leads on BNB Chain with slightly higher fees.

2.How is a DEX different from a centralized exchange (CEX)?

Unlike CEXs, DEXs give users full custody of their assets and use smart contracts to execute trades. This means higher transparency, lower counterparty risk, and no need for KYC or middlemen.

3. Which DEX Has No Gas Fees?

Gas fees are becoming a thing of the past. While Hyperliquid and dYdX use custom-built blockchains to offer a truly gasless experience, PancakeSwap uses zkSync’s ‘Paymaster’ technology to let users settle fees with their trading assets instead of holding a separate gas token.

4.What Are the Best Decentralized Exchanges for Beginners in 2026?

The best decentralized exchanges for beginners include Uniswap on Ethereum, known for its straightforward connect and swap Interface, and PancakeSwap on BNB Chain, which offers low fees and a gamified experience. For Solana users, Jupiter is the premier choice, as it automatically secures the best prices through an intuitive, user-friendly layout.

5. Can I earn rewards by using a DEX?

Yes! Many DEXs offer liquidity mining, yield farming, and staking programs that let users earn passive income by providing liquidity or holding governance tokens.

6. Do DEXs support fiat currency?

Most DEXs don’t support direct fiat transactions, but users can use on-ramps like MoonPay, Transak, or Coinbase Pay to buy crypto and then trade on DEXs.

See How Our MVP System Helps You Build the Best Decentralized Exchange

Best Decentralized Exchange — built for secure, fast, and trustless crypto trading.

- MVP System : Launch a scalable DEX with AMM, order book, or hybrid trading models.

- DeFi-Ready Modules : Integrate liquidity pools, multi-chain swaps, farming, staking, and wallets.

- Brand & Customization :Customize UI, trading pairs, fee structures, and governance.

- Revenue Engine : Generate revenue through swap fees, incentives, and premium features.

Get a free DEX strategy demo in just 48 hours — before development begins.

Book a Free Demo to launch the best decentralized exchange in 8–12 weeks and stay ahead of the market.