Just think about the last transaction you did. Maybe you paid on your debit card, or used PayPal, or even tapped your phone for a one-time transaction. A payment gateway securely routed your payment to the sellers. Payment gateways act as the backbone of the digital economy and bring together buyers, sellers, and banks within seconds.

Now we are seeing changes in payment methods recently with the introduction of cryptocurrencies like Bitcoin and Ethereum. Payment gateways constructed for cryptocurrency are a new form of payment gateway. Unlike some other payment gateways, they are faster, have fewer intermediaries, and operate cross-border.

All it comes down to is one big question: Are crypto gateways the future of digital payments, or traditional gateways still hold the upper hand? Let’s explore in the upcoming points; now let’s begin with some basics…

See How Our Crypto Payment Gateway Outperforms Traditional Systems

Crypto Payments — done smarter.

-

Instant Settlements : No intermediaries, no waiting — just direct wallet-to-wallet transfers.

-

Global Access : Accept payments from anywhere, in any crypto, without bank restrictions.

-

Low Fees : Cut down transaction costs by up to 80% compared to traditional gateways.

-

Enhanced Security : Blockchain-backed encryption eliminates chargebacks and fraud.

Experience a free branded demo of your own crypto payment gateway — ready in 48 hours.

Book a Free Demo to see how our Crypto Payment Gateway Solution can help you go live faster and cheaper than any traditional payment system.

What is a Crypto Payment Gateway?

Crypto Payment gateway is a digital payment platform that allows businesses to accept cryptocurrencies like Bitcoin, Ethereum, and other digital assets as payment. Unlike traditional gateways, these crypto payment gateways avoid the use of banks or card networks, which is the opposite of traditional gateways. They use blockchain technology to facilitate the transaction from the buyer to the sellers. This results in faster payments with lesser fees and no delays caused by a third party.

If you’d like to explore further, BitPay, Coinbase Commerce, and CoinPayments serve as examples of payment providers. They enable merchants to receive payments in Bitcoin, Ethereum, and other cryptocurrencies. When a customer pays with crypto, the payment provider converts it into the merchant’s desired currency, be it cryptocurrency or fiat. It then verifies the transaction on the blockchain and settles the payment immediately. There is no need to wait for bank clearance, which takes days.

Here are some of the main features and advantages of crypto payment gateways:

- Accepting payments from all over the globe without restrictions.

- Compared to a traditional payment gateway, it may be lower.

- Privacy and security are the main core of crypto gateways because of blockchain.

- Multiple cryptocurrency payments supported.

Although crypto payment gateway trends are in the growing stages, they are rapidly transforming the landscape for international companies that wish to adopt the newest trends in finance. While crypto gateways represent the next step in payment innovation, it all started with traditional payment gateways that most of us are already familiar with..

Understanding Traditional Payment Gateways

A traditional payment gateway system means payment through card or bank account payment, just like PayPal, Stripe, Visa, and Mastercard do. So people have trust in the traditional payment gateway and in the card system.

Here’s how they function: Upon entering your card information, it operates as the connection between the user, the bank, and the retailer. It verifies your available funds, approves the payment, and guarantees transaction security. It does work well, but it involves numerous middlemen such as banks and card networks, which may decelerate the process and increase fees.

Key Benefits of Traditional Payment Gateways:

– Globally accepted and trusted

– Support numerous fiat currencies

– Fraud detection and chargeback management

– Plug-and-play integration with e-commerce tools

As with traditional gateways, while dependable and consistent, they are bound to banks, regulations, and, in some cases, high transaction fees. Now that we’ve seen about traditional gateways, it’s time to put them head-to-head with crypto gateways to understand the real differences.

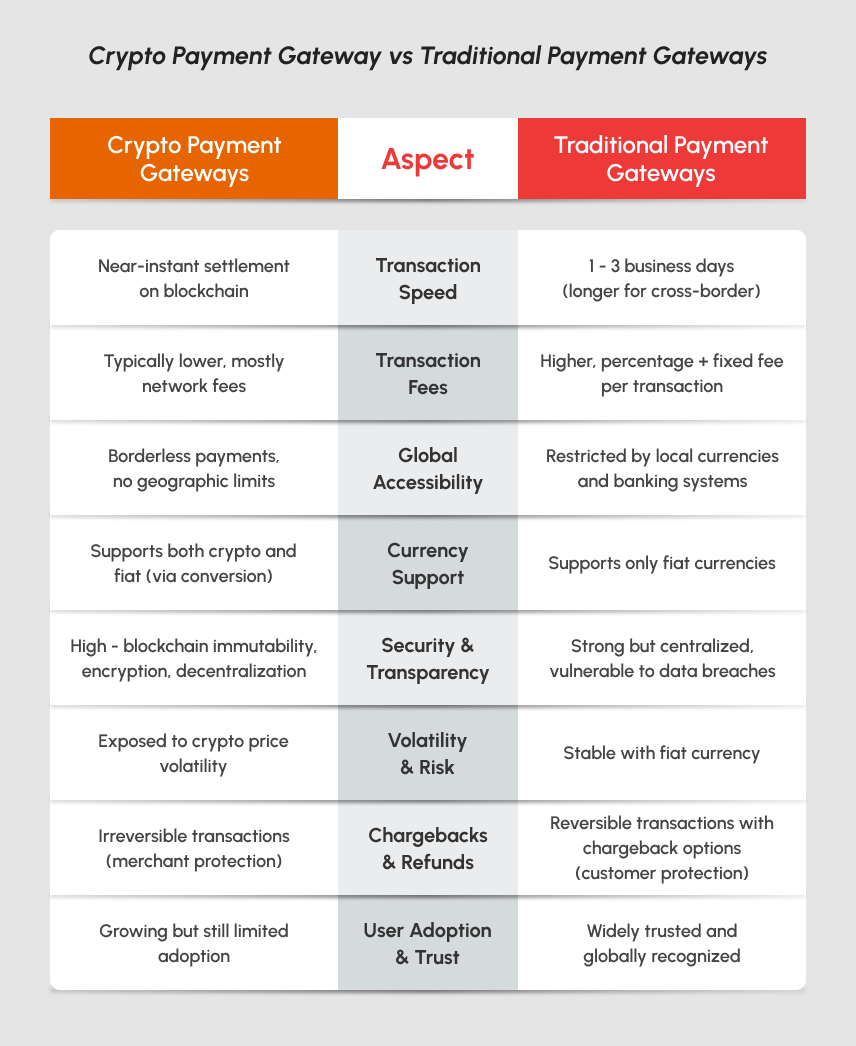

Overview of Crypto Payment Gateway Vs Traditional Payment Gateway

Above we’ve covered what is crypto and traditional payment gateways, now let us compare them directly. They each have their respective pros and cons, but the largest gap is noticed when they are both used in real-world scenarios.

Security Analysis

Crypto payment gateways stand out with their feature, the use of blockchain technology. Every transaction is documented in a clear, permanent entry on a distributed ledger. It uses private keys and strong encryption to safeguard your transactions. That said, threats like wallet hacks or stolen private keys are still a possibility.

On the other side, traditional payment gateway systems operate on a centralized infrastructure and adhere to encryption standards, use fraud detection, and comply with regulations like PCI-DSS. They are quite effective but are more prone to mass data breaches, as everything is handled via central servers.

Also Read : How to Develop a Crypto Payment Gateway?

Cost & Fee Structure

Crypto payment gateways usually keep costs lower. A transaction does require network fees, but that is often the only charge, as the banks or card networks do not impose any network fees of their own. This can be extremely cost-effective with international payments as well as large transaction volumes. Fees are likely to rise if there is congestion on the blockchain network, which is the only disadvantage.

Traditional crypto payment gateways are usually more costly. Use of these systems by merchants triggers the expenditure of a percentage, typically ranging between 2 and 3%, in addition to a fixed fee per transaction. This tends to use up a lot of money over periods of time.

Speed & Settlement

Crypto payment gateways offer fast transactions that can be verified and settled almost instantly once they are confirmed on the blockchain. This implies that the daily tasks of firms can be improved, as they do not have to wait to get access to funds.

Traditional payment methods tend to take approximately 1 to 3 business days for payment processing, and when cross-border transactions are concerned, these payments tend to take longer because of the banks, along with other middlemen, who have also provided additional restrictions.

Global Reach & Accessibility

Use of cryptocurrency payment methods eliminates geographical limitations of payments. Customers can pay from any part of the globe provided they have access to the internet and a cryptocurrency wallet. Payments are simple and seamless with no limits, no currency exchanges, and no international boundaries; they are direct and borderless.

In traditional payment gateways, geography and other factors tend to limit the use of traditional payment methods. Traditional payment methods are based on and operate using local currencies and the banking system and therefore tend to limit the use of cryptocurrency payments. Also, conversion charges tend to be high.

Chargebacks & Fraud Prevention

The crypto payment gateways provide one of the largest benefits to merchants, which is related to the finality of transactions. After payment has been confirmed in the blockchain, it cannot be reversed. This protects merchants by eliminating chargeback fraud. This also implies that businesses are required to manage refunds manually in case they are required.

Traditional payment processors provide the chargeback function, which lets buyers dispute and seek refunds for transactions. Although this is beneficial for purchasers, it can create significant problems for merchants, such as the risk of chargeback scams and other financial damage. Observing legislation and regulations.

Regulatory & Compliance Considerations

A cryptocurrency payment gateway’s regulatory treatment, particularly for cross-border transactions that require stronger KYC and AML compliance, is needed. Achieving compliance may be impossible due to the varying demands of each jurisdiction.

Traditional payment systems are established and strongly regulated. Such systems are more trusted by governments and easier for businesses to adopt without legal ambiguity because of their adherence to financial laws.

With these differences in mind, let’s move from theory to practice and explore how both gateways are being used in the real world.

How Crypto & Traditional Payment Gateways Work in the Real World?

When it comes to real-world use cases, both crypto and traditional gateways have found their place across industries. Beyond theory, the true impact of payment gateways is visible in how businesses are using them today.

- Crypto payments are now getting popular in industries like e-commerce, gaming, travel, and even the real estate sector too. Also, the use cases of crypto payment gateway are really extending to popular brands. Business giants like Microsoft and Shopify, and Tesla (at a certain period) made notable attempts to popularize the use of cryptocurrencies.

- The pillars of online payments continue to be the well-established payment gateways of the past. Their role remains central in retail, healthcare, food delivery, and subscription-based services due to ingrained trust and user experience that clients and merchants alike are familiar with.

With the continuous growth of adoption on both ends, startups stare at an important matter to resolve: should they accept cryptocurrency, stick to the traditional methods, or go hybrid?

How to Choose the Right Payment Gateway for Your Business?

So, what’s the best choice for your startup?

- In case your customer’s headquartered midway across the globe, very technologically advanced, and accepting of the new age digital currencies, crypto payment gateways can offer you a distinct advantage in competition.

- If your business has shoppers that use credit/debit cards, combined with their trust in traditional payment systems, then the traditional payment gateways are the best and safest option.

- The bulk of startups tend to have users from both traditional and crypto economies. Hence, it would be a wise choice to strive toward hybrid payment systems where crypto and traditional payments run in parallel. This way, you capture the trust of traditional users while also tapping into the fast-growing crypto economy.

As the majority of startups are best helped by hybrid approaches, it is important to shift our focus to the future of payment gateways overall. So, To Conclude…

Building a Scalable Payment Gateway with Industry-Experts!

In the payment gateway space, both traditional and crypto solutions are evolving. Due to their adoption on a long-term basis, stability, and trust, traditional payment gateways stand in the lead. On the other hand, instant payments, lower fees, and borderless payments are the hallmarks of the crypto payment gateways, and their further adoption will shape the future. However, the real advantage will go to businesses that adapt to both systems and give customers more flexibility.

If you’re planning to integrate a payment system or development, consider a market’s best crypto payment gateway development company, like Coinsclone. We ensure a smooth and secure integration. Because of our years of experience in the field of blockchain, we provide the following:

- Customized payment gateway solutions that fulfill your specific business requirements.

- Support for multiple currencies, including Bitcoin, Ethereum, and other leading cryptocurrencies.

- Advanced security measures to safeguard your transactions and customer information.

- 24/7 support and assistance from an experienced development team.

Get in touch with Coinsclone today and build a powerful crypto payment gateway that takes your business to the next level.

See How Our Crypto Payment Gateway Outperforms Traditional Systems

Crypto Payments — done smarter.

-

Instant Settlements : No intermediaries, no waiting — just direct wallet-to-wallet transfers.

-

Global Access : Accept payments from anywhere, in any crypto, without bank restrictions.

-

Low Fees : Cut down transaction costs by up to 80% compared to traditional gateways.

-

Enhanced Security : Blockchain-backed encryption eliminates chargebacks and fraud.

Experience a free branded demo of your own crypto payment gateway — ready in 48 hours.

Book a Free Demo to see how our Crypto Payment Gateway Solution can help you go live faster and cheaper than any traditional payment system.