Did you know that many crypto traders prefer P2P crypto exchanges over others for their security and transparency?

With this growing demand, the potential for launching your P2P crypto exchange has never been higher. A P2P (peer-to-peer) crypto exchange is a decentralized platform that allows users to trade cryptocurrencies directly with each other, without the need for an intermediary. It connects buyers and sellers, enabling them to execute trades securely. Top P2P Crypto Exchanges like Paxful, OKX, and others are now seeing billions in trading volume and have become reputable brands in the industry.

If you’ve ever wondered how to replicate such success, starting a P2P crypto exchange might be your key. This blog explores everything you need to know, from benefits to creation approaches and revenue models, to successfully start a P2P Crypto Exchange Platform. Let’s first understand…

How to Start a P2P Crypto Exchange — the Smart Way!

Building your own exchange doesn’t have to take forever. With our MVP Launch System, you can go live 90% faster.

- No Code Setup : Wallets, escrow, and matching engine — ready to go.

- Peer-to-Peer Freedom : Enable direct crypto trading between users — securely.

- Custom Branding : Your name, your design, your market.

- Revenue Ready : Earn from trade fees, ads, and premium features.

Get a free branded P2P exchange demo in just 48 hours — before spending a cent.

Book a Free Demo and see how we can take you from idea to live P2P exchange in just 2–4 weeks.

What is a P2P Crypto Exchange?

A Peer-to-Peer (P2P) crypto exchange is a decentralized platform. It allows users to trade cryptocurrencies directly with each other. This means they can skip traditional intermediaries, like banks or centralized exchanges. This model enables secure, clear, and affordable transactions. It connects buyers and sellers according to their preferences.

P2P Crypto exchanges include features like escrow services, user ratings, and dispute resolution. These help ensure trust and safety in trades. They provide more control over trading terms like pricing and payment methods. This makes them a great choice for people wanting freedom in their cryptocurrency transactions. Now, it’s time to know…

How Do P2P Crypto Exchanges Work?

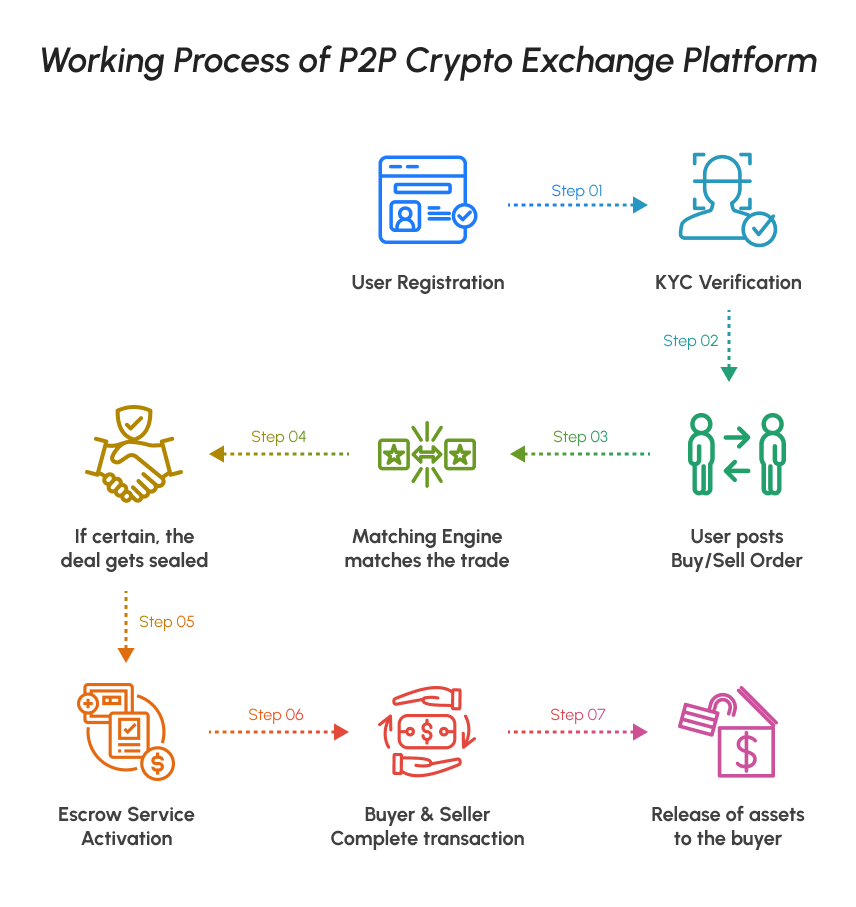

P2P crypto exchanges operate on a straightforward approach. It begins with user registration, where individuals create an account on the platform. To ensure legal security, the exchange requires KYC verification, so the user’s identity is authenticated before enabling trading activities. Once verified, users can post their buy or sell orders, specifying the details like the cryptocurrency.

Now, a matching engine identifies potential orders and matches buyers and sellers based on requirements. When both parties agree to the terms, the deal is confirmed, and the platform’s escrow service steps in. The escrow system temporarily holds the assets involved in the transaction to safeguard both parties. After the buyer and seller settle payment, the escrow service releases the asset to the buyer, completing the transaction. This process ensures security at every step, making Peer to Peer crypto exchanges a reliable trading platform for users worldwide. With this understanding, let’s explore why launching one is beneficial.

Types of P2P Crypto Exchanges (Choose the Right Model Before You Build)

Before you start building a P2P crypto exchange, you must decide which operational model you want your platform to run on. This decision shapes your technology stack, security approach, compliance requirements, and long-term scalability. Most competitors skip this step entirely, but Google rewards content that clearly explains the architecture choices founders must make.

Here are the four major P2P exchange models and when each one makes sense:

1. Escrow-Based P2P Exchanges

This is the most widely used model (Binance P2P, OKX P2P, Remitano).

In escrow-based exchanges, the platform temporarily locks the seller’s crypto in an escrow wallet until the buyer completes payment. Once the seller confirms the payment, the system automatically releases the crypto.

Best for:

- Entrepreneurs entering the market for the first time

- Platforms focused on fiat-to-crypto trades

- Regions with high fraud risk where trust enforcement is crucial

Strengths:

- Higher trust between anonymous traders

- Strong dispute resolution capabilities

- Clear audit trail for compliance

Limitations:

- Requires strong backend security

- Escrow operations must be risk-proof

If your goal is to build a marketplace where users rely on platform-mediated trust, this is the safest model.

2. Smart Contract-Based P2P Exchanges

Here, smart contracts replace centralized escrow. The contract automatically triggers crypto locking, payment verification logic, and release conditions without intermediaries.

Best for:

- Founders targeting DeFi users

- Platforms prioritizing transparency and automation

- Cross-chain or token-based ecosystems

Strengths:

- Fully transparent transaction logic

- Eliminates manual escrow handling

- Lower operational overhead

Limitations:

- Fiat trades require off-chain oracles

- Smart contract bugs become major risks

- Not suitable for highly regulated markets

Choose this model if your audience prefers decentralized trust instead of platform-driven trust.

3. Centralized Matching With P2P Settlement

In this hybrid model, the platform runs a centralized order-matching engine, but the final trade settlement happens P2P.

Think of it as: centralized speed + decentralized ownership

Best for:

- Exchanges expecting high-volume traders

- Platforms requiring real-time price discovery

- Multi-market matching (spot + P2P)

Strengths:

- Very fast order execution

- Flexible product expansion

- Ideal for scaling globally

Limitations:

- Requires an advanced matching engine

- More complex compliance oversight

This model gives you the performance of a traditional exchange while keeping the peer-to-peer settlement flow intact.

4. Fully Decentralized P2P Exchanges

Here, users connect wallet-to-wallet with no central authority controlling custody, matching, or settlement. This model uses decentralized protocols and peer discovery mechanisms instead of a platform-managed backend.

Best for:

- Web3-native founders

- Ecosystems with strong DAO or community-driven governance

- Markets where user privacy and autonomy are top priorities

Strengths:

- Zero custodial risk

- Maximum transparency

- Highly censorship-resistant

Limitations:

- Harder to regulate

- Fiat integrations are minimal

- Lower liquidity compared to centralized or hybrid models

This is ideal if your vision is a purely decentralized, user-owned trading network.

Step-by-Step Guide: How to Start a P2P Crypto Exchange

Starting a P2P crypto exchange isn’t about writing code first—it starts with clarity, architecture, compliance, and the right operating model. This step-by-step framework walks you through the real sequence founders, CTOs, and product teams follow when building a P2P trading platform.

Step 1: Define Your Business Model

Your business model determines your revenue, liquidity strategy, features, compliance scope, and even the user persona you target. Before touching technology, make these decisions:

Fee Structure

Decide how your platform earns:

- Trading fee model: Percentage or flat fee per trade

- Escrow fee: Charges for holding assets in escrow

- Listing fees: For merchants or power sellers

- Withdrawal/deposit fees

- Premium seller verification fees

Your fee structure must align with regional competitiveness and liquidity incentives.

Asset Selection

P2P exchanges thrive when they support assets users actually trade, not what founders assume.

Choose:

- High-demand cryptocurrencies: BTC, ETH, USDT, USDC

- Local fiat pairs based on geography

- Additional altcoins depending on liquidity partners

More assets = more compliance + more liquidity requirements. Start focused.

Target Geography

Your entire operational flow shifts based on geography:

- Payment methods

- Local KYC rules

- Partner banks

- Licensing requirements

- Liquidity providers

Choose regions where P2P trading is high (India, Nigeria, Vietnam, UAE, Turkey) and scale outward.

Step 2: Choose the Right P2P Exchange Architecture

Your architecture determines scalability, performance, and long-term operational stability. Build on a structure that can evolve with your business.

Modular Architecture

Keep every core function—escrow, dispute handling, wallet service, matching logic—separate.

This allows faster upgrades without downtime.

Scalable Infrastructure

P2P volumes spike during bull markets. Use:

- Load balancing

- Auto-scaling clusters

- High-throughput messaging queues

Microservices-Based System

Break the platform into independent services such as:

- User service

- Trade service

- Payment service

- Wallet service

- Escrow service

- KYC service

This improves observability, deployment speed, and fault isolation.

API-First Development

Your platform must expose APIs for:

- Wallet integrations

- Fiat gateways

- Liquidity providers

- External compliance services

- Merchant apps

API-first architecture makes the exchange extensible from Day 1.

Step 3: Finalize Your Feature Set

Your P2P exchange’s success depends on offering features that reduce risk and increase user trust.

Here are the essential core features (link internally to your P2P Exchange Features page):

- Matching engine: Efficiently pairs buyers and sellers

- Escrow management: Locks assets until payment confirmation

- Multi-wallet support: Hot, warm, and cold storage layers

- Dispute resolution system: Protects users from fraud

- KYC/AML integration: Ensures compliance with local regulations

- Arbitration module: Enables human review for complex disputes

Start with a lean roadmap, then layer on advanced features as liquidity grows.

Step 4: Choose the Right Tech Stack

A serious P2P exchange cannot rely on generic tech. Use production-grade components built for high concurrency and resilient operations.

Backend

- Node.js, Go, Java

Designed for handling transaction-heavy, asynchronous operations.

Frontend

- React, Vue

High-performance, responsive UIs for web and mobile.

Blockchain Layer

- Ethereum

- Tron

- BNB Smart Chain

Widely adopted networks for escrow, transaction verification, and optional smart contract automation.

Database

- PostgreSQL

- MongoDB

Secure, scalable, ACID-compliant storage for user data and trade logs.

Matching Engine Languages

- C++ or Rust

Used for high-speed, low-latency matching processes essential for hybrid P2P models.

Step 5: Integrate the Liquidity Layer & Escrow Engine

This is the section most blogs completely overlook—and it’s where trust is won or lost.

Liquidity Layer

Without liquidity, your P2P exchange becomes an empty marketplace.

Options include:

- Internal liquidity pools

- Market makers

- External liquidity providers

- Linking multiple P2P marketplaces (if your architecture allows)

Escrow Engine

Your escrow flow must be risk-proof:

- Asset lock-in

- Payment verification

- Auto-release logic

- Timeout cancellation

- Fraud risk rules

- Two-step arbitration triggers

A secure escrow engine is the backbone of every successful P2P exchange.

Step 6: Compliance, KYC, & Regional Regulations

P2P exchanges operate across borders, meaning compliance cannot be an afterthought.

United States – MSB licensing, AML compliance, and state-level regulations.

UAE – Crypto-friendly but requires commercial licensing, KYC/AML, and auditing.

European Union – MiCA regulations govern custody, AML, exchange operations, and reporting.

Your compliance stack must map to your geography before development begins to avoid expensive rewrites.

Step 7: Development, Deployment & Testing

Now you move into execution.

- Backend development: Core services, wallets, escrow, APIs

- Frontend development: Dashboard, trade pages, dispute flows

- Security hardening: Pen tests, transaction monitoring, rate limiting

- QA cycles: Functional, load, integration, and user acceptance testing

- Deployment: Containerized deployment with CI/CD automation

A P2P exchange requires multi-layer testing, especially around escrow and dispute logic.

Step 8: Launch & Growth Plan

Most founders underestimate distribution. Liquidity, not code, decides your success.

Your launch plan must include:

- Merchant onboarding: Verified sellers to create instant liquidity

- Referral programs: Viral loops to attract new users

- Community building: Telegram, Discord, regional groups

- Influencer partnerships: Crypto YouTubers and local traders

- Localized payment options: Essential for cross-border adoption

- Gradual expansion: Start with one geography, then scale

Just remember that the key lies in planning every detail and executing it according to your chosen method will bring in fruitful results. Now, let’s see about the,

Key Approaches to Start a P2P Crypto Exchange Platform

When exploring how to start a P2P crypto exchange, it is significant to choose the right strategy. This choice will determine your platform’s overall flow and your business strategy. Let’s see about the two main strategies and what they imply,

- Development of P2P Crypto Exchange from Scratch

- White Label P2P Crypto Exchange Solution

Developing a P2P Crypto Exchange from Scratch

This is one of the widely used strategies, which implies starting everything from the very start. Here, every aspect of the platform is developed from the bottom up. Be it design, features, functionality, security mechanics, or any other element are coded and developed according to your unique business goals. The team of experts and professionals who are well-versed developers, designers, and blockchain experts will together start the P2P crypto exchange platform.

Key Attributes

- Developing from scratch gives you complete freedom to add or alter advanced and unique features tailored to your target audience.

- On the contrary, note that, as it is developed from the ground, extensive care is necessary. So, the cost and timing frameworks can be taken accordingly.

Best suited for – Businesses with long-term goals and time frames, and a bigger budget.

White Label P2P Exchange Software

A White label P2P Crypto exchange solution is a pre-built and customizable solution that can be tailored according to your unique business goals and objectives. This solution comes packed with essential features and functionalities, making it a cost and time-saving alternative. This P2P Crypto Exchange script lets you customize the platform’s design, branding, and even some advanced features to align with your business requirements. This approach lets you focus more on customizing the platform to your brand and user experience.

Key Attributes

- You can save the extensive effort required to build everything from scratch. By incorporating minor tweaks and customizations, you can reduce the time while still delivering a tailored solution.

- As they are pre-built and tested, the risks of security breaches are really limited. This ensures a reliable and credible exchange, offering peace of mind to both owners and users alike.

Best suited for – Startups or businesses seeking immediate solutions with a balance between speed, cost, security, and customization.

No matter what strategy you choose, the key lies in understanding your business goals, target audience, and available resources. Overall, selecting the right approach is as crucial as the smooth execution. So, let’s focus on….

Business Benefits of Starting a P2P Crypto Exchange

If you are looking to create a P2P crypto exchange now, then you might be on the right track. Building your own Peer-to-peer platform brings several benefits; let’s list them out.

Global Accessibility

By starting a P2P Crypto exchange platform, you are gaining free access to the global markets easily. The crypto traction is not anywhere near slowing down, so you can easily connect to the markets directly without facing any geographical constraints.

Market Opportunities

The crypto market is fast evolving, and still, the search for the best P2P Crypto exchange platform continues. By offering a P2P platform with advanced features, you can address the growing demand for secure and decentralized trading platforms.

Revenue Opportunities

P2P Crypto Exchange is a highly lucrative business model with multiple revenue streams. You can earn profits by levying trading fees, withdrawal fees, listing fees, charging for premium services, and running promotional campaigns.

Community of Your Own

Starting a P2P Exchange Platform will give you the privilege of connecting like-minded individuals together. A well-functioning, secure exchange naturally creates a loyal user base, which helps increase the platform’s credibility.

Customizable Platform

Starting a P2P Exchange platform offers you the flexibility to design and add elements based on your business requirements. It may be the platform’s logo, interface, design, or theme; everything can be customized, reflecting your brand’s vision and personality.

If this strengthens your idea of starting a P2P Crypto exchange, to help you better, here is a list of must-have features.

Challenges in Creating a P2P Crypto Exchange and How to Overcome Them?

When looking to start a P2P Crypto Exchange Platform, you may face several challenges and shortcomings that require careful planning. Here is a list of some challenges faced when starting a P2P crypto exchange,

Regulatory Challenges

Legal and regulatory frameworks on cryptocurrency are evolving and mostly vary significantly across various regions. These can even lead to temporary or permanent bans, hefty fines, and other legal actions.

Tip

Hiring Crypto and blockchain-based Legal advisors can guide you and simplify the process. Planned and obtained necessary licenses and certifications for operating in specific regions.

Scalability Issues

As the P2P trading platform grows, handling a higher volume of transactions and users can strain your platform’s infrastructure and cause server issues.

Tip

Design your platform using scalable technologies and implement cloud-based infrastructure to handle sudden traffic spikes. You can optimize the platform’s backend to handle a growing user base.

AML/KYC Requirements

Ensuring your platform complies with Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols are must to prevent illegal money laundering activities. However, this can frustrate the platform user, as the verification processes are usually lengthy and complicated.

Tip

Partnering with reliable third-party providers who specialize in compliance solutions can be helpful. Also, using necessary AML/KYC tools can speed up the verification processes while protecting sensitive information.

Technical Issues

When looking to build a P2P Crypto exchange, one may face challenges in building and maintaining the technical infrastructure of a P2P crypto exchange. This includes server downtime, bugs, transaction delays, poor platform performance, and integration failures with 3rd party services or blockchain networks.

Tip

Getting in touch with professionals allows you to handle such situations with ease. Their dedicated technical support team will thoroughly test the platform and fix any bugs that are identified.

Credibility Risks

When looking to start a P2P Crypto exchange, Trust issues are the most common challenges faced along the way. New platforms often struggle to gain trust in a market filled with scams and fraudulent exchanges. Thus, without trust, there may be a small number of users who are willing to trade on your platform.

Tip

Start to build trust by providing clear information about your platform, team, capacity, and security mechanics. Try displaying your reviews and feedback received from the clients.

Unpredictable Pricings

The Cryptocurrency market is mostly affected by price volatility. The prices highly fluctuate, which can make users hesitant to engage in P2P trading and complicate pricing strategies. They may worry about incurring losses here.

Tip

You can offer a price lock feature to protect users from sudden market swings during transactions. Also, enabling dynamic pricing algorithms can make the prices adjust according to real-time market conditions.

By addressing these challenges proactively and using the right strategies, you can create a robust, secure, and scalable P2P crypto exchange. Aside from these challenges, knowing about the budgetary concerns is also important.

Budget Constraints In Starting A P2P Crypto Exchange

When you launch a P2P crypto exchange, many factors play an important role in determining the overall cost. These influencing factors together outline the cost of starting a P2P crypto exchange. Balancing these elements strategically is necessary when planning a healthy budget. Here‘s a list of those influencing factors,

- Chosen Creation Method

- Decided Tech Stacks

- Security Infrastructure

- Planned Features and Functionalities

- Legal and Licensing requirements

- Chosen Geographical Areas

- Choice of Blockchain Network

- Marketing Approaches

- Project Complexities

- Post Maintenance and Upgrades

- UI/UX Requirements

- Expertise of the Developer Team

- Given Time Frame

- P2P Platform’s Scalability Needs

While these costs may directly influence your budget, the actual cost may vary based on your personal choices and unique business goals. Careful planning of these aspects can help you align your budget with your goals, ensuring a smooth and successful launch. Try prioritizing essential features and services during the initial stages, and gradually expand your platform as your user base and revenue grow. Be it choosing to develop a P2P exchange from scratch or using a white-label P2P solution, aligning your budget with your business goals is your key to success.

Now that you’ve understood the essentials of launching and managing a P2P crypto exchange, it’s time to explore the primary ways a P2P exchange can bring in revenue.

Create a 10X Faster Secured P2P Cryptocurrency Exchange

Cost-effective, White-Label Solution, Premium Features, Customizable. Live Demo Available.

How Does a P2P Crypto Exchange Make Money? – Explore The Revenue Model

Generally, Crypto exchanges are known for their profit potential, and a peer-to-peer crypto exchange platform is no different. Here are some of the primary and top lucrative revenue models of P2P Exchange platforms,

Transaction Fee

Transaction Fees are the primary source of income when you have a P2P crypto exchange platform. This is charged for each and every transaction conducted on the P2P crypto exchange platform. This fee is charged in the form of a small fixed sum or a fixed percentage of the processing transaction.

Listing Fee

When you create a P2P crypto exchange platform, make sure that you also have a basic number of followers. In this case, there may be companies that will be interested in listing their tokens in your exchange. And, for doing so, you can levy them a listing fee, which can benefit you every time they list their tokens.

Premium Features

When looking for how to start a P2P crypto exchange, try adding subscription-modeled features to your platform. With this, you can introduce advanced features, or exclusive benefits, and make them member-only plans and charge a fee for them.

Advertisements & Collaborations

Your P2P Crypto exchange platform can earn a good sum of money by running advertisements. Also, encouraging cross-selling, third-party advertisements, partnerships, and collaborating with influential brands can generate income.

Referrals

This is not the direct source of income, but it has the ability to increase the revenue by luring in more new users to the platform. With this referral feature, your platform users can earn rewards for referring new users to the platform, thereby increasing opportunities.

To Conclude…

Your vision to start a P2P crypto exchange is an ambitious journey that has more fruitful possibilities. This blog covered everything from the benefits to revenue streams of the P2P crypto exchange platform, guiding and simplifying your journey. Also, the ultimate success lies in the execution, and this is where having the right tech Partner can make all the difference.

Coinsclone is a leading P2P Crypto Exchange Development Company, offering blockchain-based services for the past decade. With our proven expertise, customized solutions, and a team of blockchain experts, we’ll ensure your P2P exchange stands out in the competitive crypto market. We create scalable and future-ready solutions that turn your ideas into impactful exchanges.

Ideas are sometimes easy, while implementing them may be hard. But with Coinsclone, you don’t have to worry!

How to Start a P2P Crypto Exchange — the Smart Way!

Building your own exchange doesn’t have to take forever. With our MVP Launch System, you can go live 90% faster.

- No Code Setup: Wallets, escrow, and matching engine — ready to go.

- Peer-to-Peer Freedom: Enable direct crypto trading between users — securely.

- Custom Branding: Your name, your design, your market.

- Revenue Ready: Earn from trade fees, ads, and premium features.

Get a free branded P2P exchange demo in just 48 hours — before spending a cent.

Book a Free Demo and see how we can take you from idea to live P2P exchange in just 2–4 weeks.