The market for cryptocurrencies in the European Union has entered a crucial period following the implementation of Markets in Crypto-Assets (MiCA). Europe captures nearly 20% of the global transaction volume in cryptocurrencies, and institutional investors participate on a steady basis due to the newly established regulations. Reports from the industry say that up to 60% of the crypto-related businesses in the European Union have changed their operations to be in compliance with MiCA, indicating that strong market acceptance is the case.

MiCA regulation unites fragmented national frameworks with a unified compliance standard, creating a transparent and friendly ecosystem for investors. This shift reduces regulatory unpredictability while unlocking EU-wide market access. Consequently, Europe is now known as one of the largest and most regulated places for cryptocurrency trading, thus making MiCA compliance a necessity for strategizing rather than a limitation. In that case, most of the business people and newbie startups are heading towards to EU Market with the query in their mind, “How to start a legal crypto exchange in Europe?”…

So, This sudden crypto market growth is fueled by a new legal backbone in Europe. To understand Europe’s rise to a global crypto powerhouse, we must examine the specific framework of MiCA.

Launch a MiCA-Compliant Crypto Exchange in the EU — Faster & Smarter!

Crypto Exchange Development — built for Europe’s regulatory future.

- MiCA-Ready MVP System: Launch a crypto exchange aligned with EU MiCA regulations.

- Rich Liquidity & Wallets: Secure, compliant wallet & liquidity designed for EU standards.

- EU-Focused Branding : Brand & compliant market setup — customized for European users.

- Built-In Revenue Engine : Generate Income through MiCA-aligned monetization models.

Get a free branded demo of your MiCA-compliant exchange within 48 hours — see the platform before making any investment.

Book a Free Demo to discover how our MiCA-Compliant Crypto Exchange Solution helps you go from idea to a regulated, live exchange in just 2–4 weeks.

What Is MiCA and Why It Matters for Crypto Exchanges in 2026?

The Markets in Crypto-Assets (MiCA) law is a legal system approved by the European Union to monitor the use of digital currencies and other corresponding services in all the member nations. Also, it governs the issuance, trading, custody, and transfer of crypto assets while strengthening market integrity, financial stability, and consumer protection. All Crypto-Asset Service Providers (CASPs) are affected by MiCA, and these are the centralized exchanges and custodial platforms providing cryptocurrency services in the EU.

In 2026, MiCA is a must for all crypto exchanges that want to seek legal status in the European market. There are strict controls on the licensing, governance, KYC/AML, asset segregation, and transparency aspects that the regulation enforces on the exchanges, among others. Moreover, the compliant exchanges with the rights of the local passporting across the Europe, which is why MiCA turns into an essential factor for the growth that is both large-scale and sustainable.

These regulations are more than hurdles, they are strategic tools. Thus, by meeting these standards, exchanges unlock a massive, borderless market and a major competitive edge.

Benefits of Launching a MiCA-Compliant Crypto Exchange in European Union

Step into the European market with a crypto exchange; the regulations have changed in favor of investors.

Instead of dealing with 27 different sets of laws, one single permit now opens the door to the entire European Union.

The situation is such that you can start your business and gradually win over a million customers, all this legally and safely.

One License, 27 Markets

The primary benefit for your business is the concept of “passporting.” Previously, for operating in three countries like France, Germany, and Italy, you needed to go through the licensing process with each of the governments. However, by 2026, it will be sufficient to obtain a license in just one EU country. After acquiring that “passport,” you can legally provide your services across all 27 EU member states at once.

Building Trust with Everyone

In the early days, people were often afraid of crypto because of scams or “hacks.” Because MiCA has very strict rules about how you handle money, having a MiCA-compliant exchange is like having a “seal of approval.” It tells regular people (retail) and big companies (institutional) that your platform is safe, professional, and follows the same high standards as a bank.

Long-Term Security

Regulations used to change every few months, which was a nightmare for business owners. MiCA provides a clear, steady rulebook that won’t disappear. This stability means you can plan your business for the next 5 or 10 years without worrying that a new law will suddenly shut you down.

To beat the competition and save money, many leaders are choosing a “white label” approach. Here is why it’s the best way to launch:

Why Choose A MiCA-Compliant White-Label Crypto Exchange Solution?

Building your own exchange in Europe from scratch is slow, expensive, and risky. Thus, the smartest way to enter the European market is to use a “white label” solution, a ready-made platform that is already build to follow all MiCA rules.

Launch in Weeks, Not Years!

Building a crypto exchange from scratch is like building a car from scratch; it requires a huge team and at least 12 to 18 months of work. A white-label exchange is like buying a high-performance car that is already build; you just need to paint it and put your logo on it. Instead of waiting over a year, you can live and make money in just 4 to 8 weeks.

Save Your Money for Marketing

Developing your own software can cost over $500,000 just to get started. A white-label solution costs a fraction of that. Because the technology (the “matching engine” and security) is already build and test for MiCA compliance, you don’t have to pay a team of expensive developers to reinvent the wheel.

Focus on What Matters: Your Brand

The most successful exchanges in 2026 aren’t the ones with the “coolest code,” they are the ones with the best brand and the most users. By using a white-label partner to handle the technical “plumbing” and the legal reporting, your team can focus 100% on:

- Branding: Making your app look and feel unique.

- Marketing: Running ads and social media to find users.

- User Acquisition: Onboarding customers and making them happy.

Speed is important, but you have to know what is important while developing a white-label exchange. Let’s see that.

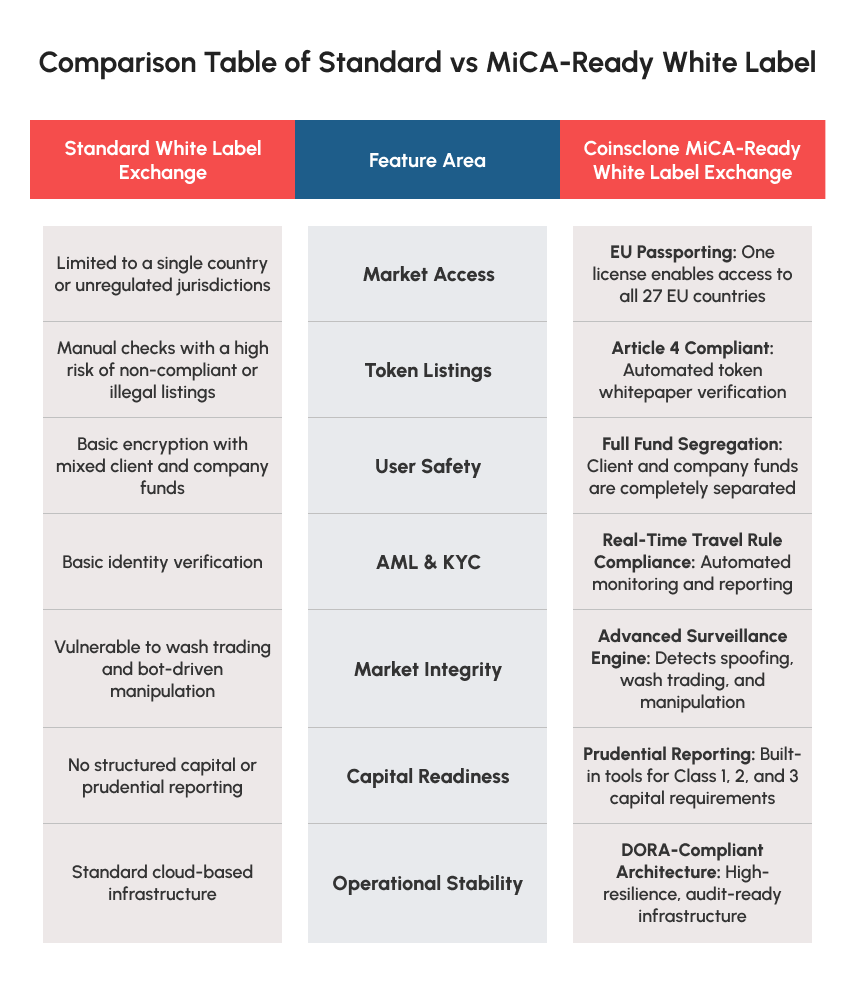

Brief Comparison Of Standard Vs MiCA-Ready Exchange

Choosing the right white-label crypto exchange software is the difference between a platform that is ready to scale and one that gets shut down by regulators. A standard setup might save money today, but it will cost you your license tomorrow. In the EU’s high-trust market, safety is your biggest selling point, but in the EU, safety comes first. Therefore, to stay legal, your white-label platform must have these essential MiCA features ready to go:

A standard setup might save money today, but it will cost you your license tomorrow. In the EU’s high-trust market, safety is your biggest selling point, but in the EU, safety comes first. Therefore, to stay legal, your white-label platform must have these essential MiCA features ready to go:

MiCA-Compliant Features Required For European Crypto Exchanges

The success of a regulated crypto exchange depends not just on speed to market, but on having the right features of a crypto exchange that align with compliance, security, and user trust. Under MiCA, these features go beyond basic trading functionality:

CASP Authorization Requirements Under MiCA

You must be authorized as a Crypto-Asset Service Provider (CASP). This means your management must be “fit and proper” (clean records and experience), and you must have a physical office in the EU.

KYC and AML Compliance for EU Crypto Exchanges

Your platform needs automated tools to verify who your users are. It also must follow the “Travel Rule,” which means sharing sender and receiver info for every transaction to stop money laundering.

Client Fund Segregation and Asset Protection

You should legally keep customer money in separate accounts from your company’s money. If your business has a problem, your customers’ funds remain safe and untouched.

Proof of Reserves

You must show that you actually hold the assets your users see in their accounts. Regular audits and transparent reports are now the law to prevent “fake” balances.

Risk Management and Security Controls

Under the DORA (Digital Operational Resilience Act) rules, your exchange must have strong protection against hackers and a plan to stay online even during a cyberattack.

Once you have the right technology, you need a clear plan. Here is the exact process to get your exchange live and licensed:

Step-by-Step Process To Launch A Crypto Exchange in EU

Follow these steps to get your MiCA-ready white-label exchange.

- Pick Your Crypto Hub : Choose one EU country (like France or Lithuania) to be your “home base.” Once they approve you, you can “passport” to the other 26 countries.

- Deploy a MiCA-Ready White Label Exchange : Partner with a white-label provider whose software is already built to meet MiCA standards.

- Align Your Token Listings with MiCA Article 4 : Make sure the tokens you list follow MiCA Article 4. This usually means they must have an official “white paper” filed with a regulator.

- Integrate EU-Grade Custody : Set up “EU-grade” custody. Use technology that keeps most assets in “cold storage” (offline) to prevent theft.

- Market Surveillance Setup : Install market surveillance tools. These are robots that watch for “wash trading” or price manipulation on your platform.

- Submit License Application : Submit your full application to your chosen country’s regulator. With a white-label partner, most of the technical paperwork is already done for you!

While your license works everywhere in the EU, where you start your journey matters. Here are the best countries to apply for your license.

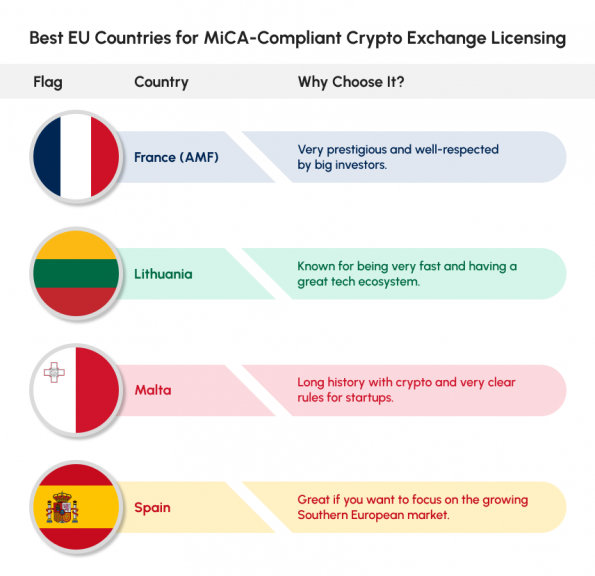

Best EU Jurisdictions For MiCA-Ready Crypto Exchange Licensing!

While you only need one license, some countries are more “business-friendly” than others. Here are the top picks for 2026:

Once you have selected your jurisdiction, the final and most important step is choosing a right development partner who can turn your vision into a reality. This is where the right technology makes all the difference. So, that’s where, Our Coinsclone Team joins the play!!

Why Choose Coinsclone for MiCA – Ready White Label Exchange Development?

The European Union (EU) has officially become the world’s safest and largest regulated market for digital assets. To succeed in this competitive landscape, you need a partner with a proven track record. As a premier Cryptocurrency Exchange Development Company, Coinsclone offers the technical expertise and industry insights necessary to build a platform that is both compliant and powerful. Also, we ensure your business is ready to meet the high standards of the European market from the very start to help you launch a crypto exchange safely.

Moreover, our White Label crypto exchange software provides a fast and reliable way to launch your brand without the long wait of traditional development. Also, it is for top-tier security and a smooth user experience, allowing you to focus on your business goals while we handle the complex technology.

So, Why Wait? Contact us today for a demo and let Coinsclone help you establish a dominant presence in the global crypto space.

Launch a MiCA-Compliant Crypto Exchange in the EU — Faster & Smarter!

Crypto Exchange Development — built for Europe’s regulatory future.

- MiCA-Ready MVP System: Launch a crypto exchange aligned with EU MiCA regulations.

- Rich Liquidity & Wallets: Secure, compliant wallet & liquidity designed for EU standards.

- EU-Focused Branding : Brand & compliant market setup — customized for European users.

- Built-In Revenue Engine : Generate Income through MiCA-aligned monetization models.

Get a free branded demo of your MiCA-compliant exchange within 48 hours — see the platform before making any investment.

Book a Free Demo to discover how our MiCA-Compliant Crypto Exchange Solution helps you go from idea to a regulated, live exchange in just 2–4 weeks.