Ironically, when looking to build a crypto exchange like Coinbase, businesses should concentrate more on infrastructure than the actual market operations.

Yes! When creating a crypto trading platform, businesses that prioritize base infrastructure, risk management, and the platform operational phase have high chances of surviving. While the market usually hypes about price movements and token launches, the real success of an exchange depends on the backup systems. Be it security layers, liquidity engines, compliance workflows, or scalable architecture, everything is important.

As crypto markets operate 24/7 with unpredictable traffic spikes, the demand for strong exchange platforms continues to rise. That’s why for businesses, a Coinbase-like exchange represents a golden opportunity. If you are one among them, then you are at the right place. So, This blog outlines how to create a crypto exchange like Coinbase. Also, we will analyze the technical architecture, business workflows, development approaches, and strategic considerations involved.

Let’s begin with,

See How Our MVP System Helps You Build a Crypto Exchange Like Coinbase!

Coinbase-style Crypto Exchange Development — simplified & scalable.

- Ready-to-Launch MVP : Go live with a Coinbase-like exchange in weeks, not months.

- Secure Wallet Infrastructure : Multi-currency wallets with enterprise-grade security

- Fiat & Crypto Trading : Enable seamless fiat on-ramps and crypto pairs from day one.

- Compliance-Ready Framework : Built to support KYC, AML, and regulatory needs.

Get a free branded demo of your Coinbase-like exchange in just 48 hours — before you invest a cent.

Book a Free Demo and learn how to build a crypto exchange like Coinbase in 2–4 weeks with our proven MVP system.

Why Should You Create A Crypto Exchange Like Coinbase?

Built with trust and compliance, Coinbase has become one of the world’s most trusted crypto exchanges. Here is a list of some of those justifying reasons that tell why choosing Coinbase will be the best option.

- Regulatory Compliance – The Coinbase platform is widely known for its strong compliance framework and transparent operations. Therefore, creating a crypto exchange like Coinbase allows you to launch a legally compliant platform.

- Simple UI – One of Coinbase’s biggest strengths is its beginner-friendly interface. Users can buy, sell, and store cryptocurrencies without facing any technical complexity. Also, replicating this will help in attracting first-time crypto users.

- Strong Security Architecture – Security is a non-negotiable factor in crypto trading. Also, coinbase involves strong security measures, including cold wallet storage, 2FA, and live threat monitoring.

- Scalable Revenue Model – A Coinbase-style exchange offers multiple monetization modules. This includes trading fees, withdrawal fees, staking services, and premium features, allowing businesses to generate consistent income.

- Global Market Reach – The Coinbase platform supports multiple fiat currencies, payment methods, and regions while adhering to local regulations. So, developing a crypto trading platform will let you enter the global market without facing any legal roadblocks.

- Proven Business Model – Coinbase represents a reliable crypto exchange model. Instead of experimenting with uncertain frameworks, building a Coinbase-like exchange gives you a battle-tested exchange architecture.

Now that you know the significance of developing Coinbase like exchange, let’s also explore,

How To Start A Crypto Exchange Like Coinbase?

In the early days, Coinbase did not just become a global crypto exchange. Also, this exchange started as a simple platform, focused on buying and selling Bitcoin, and slowly grew into what it is today. Then, this same approach might work out as the best for your business. Replicating Coinbase can be done easily.

Now let’s explore the best ways to create a crypto exchange like Coinbase, depending on your unique business goals.

Build A Coinbase-Like MVP

MVP, a.k.a Minimum Viable Product, is the smartest way to begin a crypto exchange journey. Instead of building a full-scale platform, businesses launch with only the essential features like user registration, wallet integration, basic trading, withdrawals, and more. Also, this MVP Development approach helps you enter the market quickly, understand user demand, and improve features based on the feedback. Just like Coinbase, you will cost-effectively start with minimal architecture. Moreover, this reduces the complexity and helps businesses focus on building trust first.

Custom Coinbase-Style Crypto Exchange Development

This custom development allows businesses to create a crypto exchange from scratch. From features, workflows, and design to base architecture, everything is built here based on specific business requirements. Also, this approach is ideal for businesses that want complete control over features, long-term expansion, and unique trading or compliance features. With custom development, you can start with core functionalities and keep adding advanced modules as your exchange grows.

White Label Coinbase Clone

A white-label Coinbase clone is a ready-to-deploy solution that allows businesses to launch quickly. Also, it already includes essential exchange features, security protocols, and functionalities, which can be customized according to branding and business requirements. And, this method is best for businesses that want to launch quickly, require less initial effort, and need a stable and tested framework. Moreover, this White-label crypto exchange allow businesses to start operations immediately and scale features over time without rebuilding the entire platform.

Now that we have explored the possibility and what each of these developments will do, it is also important to understand how each of these differs from the others.

MVP vs Custom Crypto Exchange Development

Choosing between an MVP and a custom crypto exchange depends on your business goals, timeline, and scalability requirements. Here is how these platforms might differ from each other,

| Aspect | MVP Crypto Exchange Development | Custom Crypto Exchange Development |

| Purpose | This is launched quickly to validate the business idea. | To build a fully tailored, long-term exchange platform |

| Feature Set | Basic trading features only | Advanced, business-specific features |

| Flexibility | Limited flexibility for future changes. | Highly flexible and future-ready |

| Scalability | Moderate, suitable for early-stage growth. | High, built to handle large user volumes. |

| Customization Level | Limited customization | Complete customization |

| Market Entry | Very fast | Slower but more strategic |

| Best Suited For | Startups testing market demand | Enterprises and serious exchange operators |

This might have made it clear about the possibilities of developing a crypto trading platform like Coinbase. Now, let’s see,

How Do Crypto Exchange Like Coinbase Works?

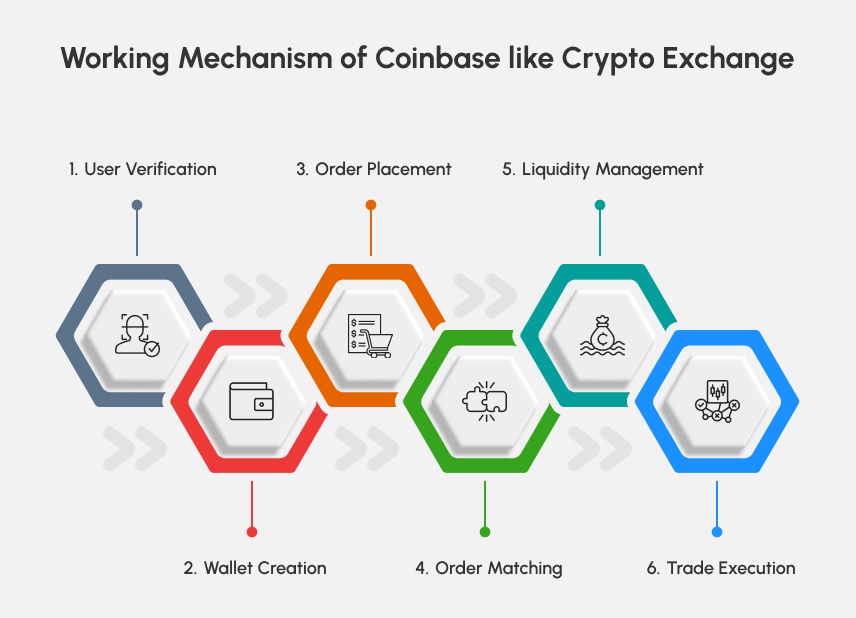

Generally, Crypto exchanges like Coinbase operate on a well-structured backend workflow. From basic user verification to trade execution, every step is carefully designed to deliver a seamless trading experience.

Step 1 – The user will begin by registering and completing essential KYC/AML and identity verifications. This is done by submitting documents such as ID proof, address proof, and biometric verification.

Step 2 – Once verified, the platform will automatically sync with the user’s crypto wallets. These wallets are used to store cryptos securely.

Step 3 – Now the users can place buy or sell orders directly through the exchange interface. Once an order is placed, it is sent to the exchange’s trading engine for processing.

Step 4 – Now, the engine will automatically match the buy and sell orders based on price, time, and available liquidity. Just like Coinbase, matching the order, the trade is executed instantly.

Step 5 – The Coinbase-like platforms manage liquidity through internal order books and external liquidity providers. This ensures no trade delays and stable pricing during high-volume trading.

Step 6 – Once the matching engine finds and matches, the planned crypto trading is set to be executed. The funds are then transferred to the user wallets.

For a smooth and simple working process like this, you would need a set of exemplary features and functionalities. Let’s explore them,

Key Features To Integrate In A Coinbase-like Crypto Exchange

Just like the Coinbase platform, the pre-built Coinbase clone scripts also contain exemplary features and functionalities. Let’s categorize them into four major categories,

User Features

- Integrated Crypto Wallets – The Coinbase-like exchanges have built-in crypto wallets. This allows users to store, send, and receive multiple cryptos within the platform.

- Transaction History – Users can view detailed trade history, wallet activity, and downloadable reports for tracking and tax purposes.

- Recurring Buy – This allows users to automatically purchase crypto at fixed gaps. This promotes long-term investing and consistent trading volume.

- Alerts & Notifications – The users will receive real-time alerts for price movements, order execution, and account activity through email or app notifications.

- Portfolio – This provides users with performance summaries, asset allocation views, and gain/loss tracking, all from a simple dashboard.

- Educational Hub – Built-in learning modules help users understand crypto basics, trading concepts, and platform features, improving the learning curve.

- Watchlist & Favorites – The users can track the selected cryptocurrencies and trading pairs without placing active orders.

Admin Features

- Centralized Admin Dashboard – A unified dashboard provides real-time insights into users, trades, liquidity, and platform performance.

- User & Compliance Management – Admins can approve KYC requests, monitor user activity, and enforce compliance policies efficiently.

- Trading Pair & Fee Control – Admins manage listed cryptocurrencies, trading pairs, and transaction fees to optimize revenue.

- Liquidity & Wallet Oversight – Real-time wallet monitoring ensures sufficient liquidity and smooth trade execution across the platform.

- Reporting & Analytics – Automated reports help admins to analyze trading volumes, revenue, and user growth for making informed decisions.

- Platform Configuration Controls – The platform admins can enable or disable features, markets, or services effortlessly.

- Alert Systems – The in-built system alerts admins about unusual activities, system issues, or wallet balance.

Security Features

- 2FA Authentication – This adds an extra layer of account protection by adding secondary authentication during logins and withdrawals.

- Hot & Cold Wallet – The funds here are split between online and offline wallets to minimize risk and protect large asset reserves.

- Data Encryption – The sensitive user data and transactions are protected through industry-standard encryption protocols.

- Withdrawal Controls – Withdrawal limits, address whitelisting, and activity tracking prevent unauthorized fund movements.

- Threat Protection – Advanced security measures safeguard the platform from attacks and ensure uninterrupted availability.

- IP Whitelisting – This restricts account access to approved devices or locations, reducing unauthorized login attempts.

- Session Timeout – This automatically ends inactive sessions to reduce account exposure.

Add-On Features

- Fiat On-Ramp & Off-Ramp – The users can easily convert fiat currency to crypto and vice versa, withdrawing funds to their bank accounts.

- Advanced Charting Tools – Real-time charts and indicators help traders analyze market trends and make informed decisions.

- Referral & Rewards Program – The incentive programs encourage user acquisition and improve the platform engagement.

- API Access – APIs allow professional traders and bots to execute high-frequency and automated trades.

- Multi-Language Support – Localization features enable the platform to cater to a global user base seamlessly.

- Staking-as-a-Service – This supports proof-of-stake assets, allowing users to stake directly from their exchange wallets.

- Institutional Accounts – This will have dedicated tools and dashboards for high-volume traders, funds, and enterprises.

Knowing all these elements involved in creating a crypto exchange like Coinbase might have made you wonder about the cost involved, right?

How Much Does It Cost To Create A Crypto Exchange Like Coinbase?

On average, the cost of developing a crypto exchange like Coinbase ranges between $15,000 to $30,000, depending on several business requirements. Based on the features, development approach, business requirements, and planned architecture, this cost might have changes. Also, this pricing typically covers basic to mid-level exchange platforms, which are suitable for startups or early-stage businesses entering the crypto market.

However, this isn’t the final cost, and it can vary significantly based on customization, scalability needs, and other influential factors. If you are still curious, let’s explore those influential factors,

Factors That Influence the Cost of building a Crypto Exchange Like Coinbase

Development Approach

Your chosen crypto exchange development method will directly impact the budget. Thus, MVP-based exchanges are usually cost-efficient, while developing from scratch requires more time, resources, and investment due to tailor-made architectures and advanced feature sets.

Besides, a clone-based crypto exchange would start around $ 15,000, making it a practical choice for businesses looking for a faster launch. Also, the custom one ranges around $ 50,000, depending on project requirements. For enterprises aiming to launch a professional or global-level crypto exchange, the investment can go beyond $60,000.

Functional Complexity

The number and type of features, such as advanced trading options, staking, margin trading, fiat integrations, and analytics dashboards, play a major role in determining cost. Also, the more complex the functionality, the higher the development effort and expense.

Security Architecture

Security is a cost driver in crypto exchange development. So, Implementing features like multi-sign wallets, cold storage, DDoS protection, penetration testing. And real-time fraud monitoring will improve the overall development costs.

Liquidity Integration

Integrating cryptocurrency liquidity providers or market makers affects the pricing. External liquidity APIs, order book sync, and high-frequency trading support will add to development and operational costs but are important for smooth trading experiences.

Regulatory & Compliance Requirements

The compliance requirements, such as KYC/AML integration, transaction monitoring, and reporting systems, vary by region. Also, supporting multiple regulatory frameworks increases the development complexity and cost.

UI/UX Design & Branding

A seamless, Coinbase-like user experience requires professional UI/UX design, responsive interfaces, and brand customization. So, the design work and user experience optimization contribute to higher development costs.

Understanding these cost factors involved will help you choose the right development strategy, avoiding unexpected expenses. Now let’s also see,

What Is the Time Taken To Launch Coinbase-Like Crypto Exchange?

The estimated time taken to develop a crypto trading platform like Coinbase would be around 6 weeks to 6 months, depending on the project’s needs. So, this timeline would be determined based on the feature complexity, customization level, and the chosen development approach. For,

- Coinbase Clone Solutions – As it is a pre-built development method, this can take around 4-7 business weeks.

- Coinbase Style MVP Exchange – An MVP crypto exchange involves only basic trading features and functionalities, and would take around 6 – 8 weeks to develop.

- Custom Crypto Exchange Development – A fully custom crypto exchange development involves building everything from scratch and requires a longer development cycle of 3-6 months or more.

Additionally, for a professional exchange, this development timeline can extend beyond 6 months, depending on advanced security layers and high-performance infrastructure. Therefore, whatever the cost and development timeline might be, the development phases would be the same.

Step-by-Step Process To Launch A Crypto Exchange Like Coinbase

Step 1: Gathering Business Requirements

The development process starts by gathering essential business requirements. Also, this includes identifying the target market, cryptos, trading pairs, revenue streams, and compliance requirements. The market research helps in understanding the current user expectations and regional regulations easily.

Step 2: Tech Architecture

Once the requirements are clear, a detailed blueprint is created. This covers system architecture, database design, trading engine structure, wallet framework, and security protocols. With that, a blueprint ensures that the exchange is scalable, secure, and capable of handling high transaction volumes.

Step 3: UI/UX Design & Mapping

A seamless user experience is important for crypto exchanges. In this step, intuitive UI/UX designs are created. Also,these are done for users’ onboarding, trading dashboards, wallets, and account management. Every aspect of the platform is planned here to ensure smooth navigation, faster trade execution, and a Coinbase-like experience across devices.

Step 4: Feature Integration & Development

This phase involves building the core modules of the crypto exchange. Also, this includes user authentication, KYC/AML integration, trading engine, wallet integration, and admin controls. Some of Essential features such as deposits, withdrawals, and transaction tracking are integrated for smooth platform functioning.

Step 5: Testing Checks

Security is a non-negotiable aspect of crypto exchange development. Here, we will implement multi-layer security measures such as encryption, 2FA, DDoS protection, and many more. Extensive testing, like functional, performance, and security testing, is conducted along with compliance validation.

Step 6: Launch Support

After successful testing, the Coinbase-like crypto exchange is deployed straight into the live environment. Upon launching, being involved in post-launch activities is also equally important. So, this includes real-time monitoring, performance optimization, and regular security updates.

The development process of building a crypto exchange like Coinbase might look simple, but it would also have its own set of challenges, right?

Major Challenges of Developing A Coinbase-Style Crypto Exchange

Building a crypto exchange like Coinbase is a highly profitable business opportunity. But this comes with technical, regulatory, and operational challenges. Knowing these beforehand will allow you to plan how to mitigate them effortlessly.

Liquidity Management

Liquidity is important for any crypto exchange. Without sufficient liquidity, users may experience delayed order execution, price slippage, and poor trading experiences. This can quickly impact the platform’s credibility.

Mitigation approach:

Integrate reliable liquidity providers and market-making solutions during the early stages of development. Also, this ensures competitive pricing and smoother trade execution from day one.

Regulatory Considerations

The crypto regulations vary widely across regions and continue to evolve. Managing KYC/AML requirements, licensing, and compliance needs can become complex, especially for exchanges targeting various geographical locations.

Mitigation approach:

Design the exchange with flexible compliance frameworks and region-specific KYC/AML integrations. Working with legal experts helps to ensure regulatory adherence without disrupting business operations.

Security Risks

Crypto exchanges are frequent targets for hacking attempts, wallet breaches, phishing attacks, and DDoS incidents. Any minor security lapse can lead to financial loss and irreversible damage to user trust.

Mitigation approach:

Implementing multi-layer security measures, such as cold wallet storage, multi-sign wallets, data encryption, two-factor authentication, and regular security audits are essential. Also, this is significant to protect user assets and platform integrity.

Scalability Issues

As the user activity increases, the exchanges must handle higher transaction volumes without any performance mismatches. Poor scalability can result in slow order matching, downtime, and failed transactions during peak trading periods.

Mitigation approach:

Adopt a scalable system architecture with good cloud infrastructure to ensure that the platform grows seamlessly with user demand.

High Development Costs

Developing a fully custom crypto exchange requires significant investment in development, security, compliance, and infrastructure. These costs can be a barrier for startups and emerging businesses.

Mitigation approach:

Opting for White Label Crypto Exchange Software can significantly reduce development costs. This approach allows businesses to launch faster without compromising on core exchange functionality.

With these challenges at bay, Now its time to see the monetary potential it has.

How To Make Money By Developing A Crypto Exchange Like Coinbase?

Developing a crypto exchange like Coinbase will open multiple revenue streams. These crypto trading platforms are designed to monetize every user action on the platform. Here is a list of some of those potential money-making factors,

Trading Fees

This is a primary revenue source, where the crypto trading platforms will earn a percentage on every buy and sell order placed by users. Coinbase-style exchanges usually rely on these

Deposit & Withdrawal Fees

The crypto trading platforms charge when users move funds within the platform. These platforms can charge a withdrawal fee for both fiat and crypto users.

Listing Fees from New Tokens

New crypto projects pay exchanges to list their tokens. This becomes highly profitable during bull markets. These are mostly done for one-time listing charges and premium visibility listings.

Margin Trading Fees

Advanced trading features generate premium income, like interest on leveraged trades, liquidation fees, and funding rate commissions.

API Access

Revenue from professional and enterprise users use these for paid API access, white-label trading tools, OTC desks, and bulk trading services. These services significantly increase profit margins.

Fiat On/Off-Ramp Commissions

These exchanges partner with banks and payment gateways for processing crypto based crad payments, bank transfers, and currency conversions. Each fiat transaction adds an additional revenue layer.

Business Benefits of Creating A Coinbase-like Crypto Exchange

Creating a crypto exchange like Coinbase brings multiple business advantages to the table. With a proven operational model and scalable infrastructure, a Coinbase-style exchange positions your business for global reach.

- Proven Business Model – Coinbase has validated the exchange model globally, reducing the business risk and increasing market confidence.

- Multiple Revenue Streams – Like Coinbase, you can earn through the trading fees, withdrawal charges, listing fees, commissions, and premium services.

- Market Demand – The crypto trading continues to attract both retail and large users, ensuring consistent platform activity.

- Quick Market Entry – Launching a Coinbase-style exchange allows businesses to enter the market more quickly than building from scratch.

- Scalable Growth – The platform can easily scale with increasing users, trading pairs, and global market expansion.

- Global Market Research – The crypto exchange operates without any geographical limitations, targeting international users.

- Revenue Generation – With in-app features like staking and subscriptions, the platform admins can easily make income.

After understanding the strong business potential of a Coinbase-style crypto exchange, the next crucial step is selecting a platform that can turn this vision into reality. That’s exactly why Coinsclone stands out as the smart choice.

Why Coinsclone Is the Smart Choice to Build a Coinbase-Style Crypto Exchange?

Coinsclone is a leading Cryptocurrency Exchange Development Company that helps businesses to launch a feature-rich Coinbase-like exchange. Coinsclone will combine robust tech, expertise, and proven frameworks. We build crypto exchange architectures that can handle everything from complex trading operations to liquidity management effortlessly.

Backed by a team of experienced professionals and developers, Coinsclone simplifies your entire development process. As a full-service provider, we offer end-to-end solutions covering requirement analysis, platform development, testing, launch, and post-deployment support. Businesses can choose between fully customized development, ready-to-deploy white label software, or advanced clone script solutions based on their time-to-market and budget requirements.

Coinsclone also specializes in OTC crypto exchange development, enabling businesses to support high-volume trades with enhanced privacy and minimal market impact. Our OTC solutions are designed to attract institutional investors and professional traders while unlocking additional revenue streams. Besides, Coinsclone is known for offering end-to-end development services. We take care of every aspect from initial consultation to final deployment in one go.

Partner with Coinsclone today to build your own Coinbase version of a crypto exchange!!!

See How Our MVP System Helps You Build a Crypto Exchange Like Coinbase!

Coinbase-style Crypto Exchange Development — simplified & scalable.

- Ready-to-Launch MVP : Go live with a Coinbase-like exchange in weeks, not months.

- Secure Wallet Infrastructure : Multi-currency wallets with enterprise-grade security

- Fiat & Crypto Trading : Enable seamless fiat on-ramps and crypto pairs from day one.

- Compliance-Ready Framework : Built to support KYC, AML, and regulatory needs.

Get a free branded demo of your Coinbase-like exchange in just 48 hours — before you invest a cent.

Book a Free Demo and learn how to build a crypto exchange like Coinbase in 2–4 weeks with our proven MVP system.