Decentralized Finance has indeed changed the very definitions of what money and trade are, and ownership of assets. For instance, ushering in the DeFi disruption, DAO-based financial protocols can barely exist as a harmonious blend of automation, transparency, and community governance. Thus, until now, they have been considered fundamental to DeFi development. With platforms like Olympus DAO catapulting to fame overnight, more startups are venturing into forkable clone scripts to replicate their success speedily and affordably. Clone scripts offer ready-to-go solutions for launching their own powerful treasury-backed decentralized platform without building it from the ground up. So let’s take a more general look at why Olympus DAO is exceptional and how a clone script will provide that jump start for your DeFi project.

See How Our MVP System Can Launch Your Olympus DAO Platform Faster

Olympus DAO Clone Script — Treasury-Backed DeFi Ecosystems Done Right.

- MVP System :Launch your community-owned reserve currency platform 90% faster.

- DeFi 2.0 Engine : Pre-integrated bonding, auto-compounding staking, and rebase logic—no complex smart contract coding required.

- Brand & Customization : Your native token name, your treasury rules, your UI, and your choice of blockchain (Ethereum, BSC, Polygon).

- Revenue Engine : Earn from liquidity pool fees, bond sales, treasury yield farming, and internal project incubation.

Get a free branded demo of your Olympus-like platform in just 48 hours — before you invest a cent.

Book a Free Call to discover how our Olympus DAO Clone Script can take you from idea to a live, treasury-backed platform in just 8–12 weeks.

What is an Olympus DAO Clone Script?

An Olympus DAO clone script is a ready-to-use decentralized finance (DeFi) software that replicates the core mechanics of the original Olympus DAO (OHM) protocol, including staking, bonding, rebase mechanisms, and protocol-owned liquidity. It enables the creation of a decentralized reserve currency system using predefined smart contracts and governance logic. By relying on a treasury-backed model instead of rented liquidity, an Olympus DAO clone supports long-term value stability through automated on-chain mechanisms.

Next, let’s take a look at how Olympus clone scripts work….

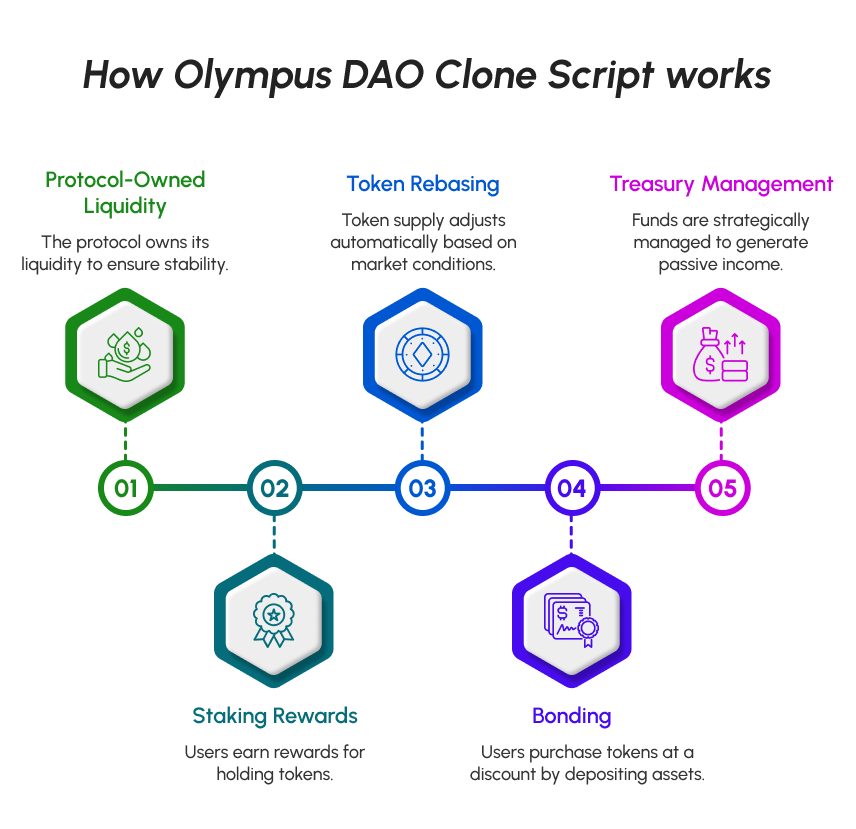

How Does the Olympus DAO Clone Script Work?

The Olympus DAO clone script works on some simple concepts: Protocol-Owned Liquidity (PoL), staking rewards, and token rebasing. In simplest terms, it is a decentralized reserve currency backed by a basket of assets held in the protocol treasury. It tries to put some minimum value and long-term price stability there.

The script embodies the smart contract logic for rebasing, which is designed to increase or decrease token supply automatically, subject to changes in market conditions and according to the design of the protocol. It also has an auto-staking feature wherein the users standing to gain lucrative APYs are entitled simply by holding the tokens, and that works as one way to create active engagement of the community. To get a little deeper, let’s first go and look at its key components.

Core Mechanisms in Olympus DAO Clone Script

The Olympus DAO clone script operates based on some key mechanisms that drive value formation and sustain changes. Each of the mechanisms is pertinent in maintaining protocol stability. Let us go through the details of how this works.

Bonding

Bonding allows users to purchase the project’s native token at a discount by depositing liquidity assets like stablecoins or LP tokens. So, these asset deposits are added to the treasury of said protocol, working for the long-term value and sustainability of the ecosystem.

Staking

Staking encourages users to hold tokens by giving out high APY rewards. As users stake, their balances increase over time due to the expanded supply through rebasing. This effectively regulates volatility so that there is demand for the token.

Treasury Management

This is the concept of Olympus DAO that is said to be built on a treasury containing some reserve funds for each token in circulation. Treasury funds can also be strategically channeled into other DeFi protocols to generate passive income for making the system more sturdy.

Let’s talk about the distinguishing features of the Olympus DAO clone script.

Key Features of Our Olympus DAO Clone Script

The key features are the core part of our Olympus clone script. Let us take a look at how the new functionality strengthens clone scripts.

- Custom Tokenomics & Rebase Logic: It works on a configured reserve-backed token supply model and rebasing parameters based on requirements.

- Bonding & Staking Smart Contracts: Enable seamless interactions with the treasury and incentivize users effectively.

- Decentralized Governance: Allowing the community to cast votes for upgrades, policies, and treasury activities.

- Liquidity Pool & Treasury Dashboard: Analytical data and management of treasury assets in real-time.

- Frontend UI & Analytics Tools: Map out a visually very engaging and data-rich experience for users.

- Multi-Chain Support: Deploy your protocol on Ethereum, BSC, or Polygon, or even test the waters on a non-EVM chain.

The point really comes down to modularity and customization. Each feature can be altered to either directly implement your vision or fulfill some other objective. However, features are worthless without equal benefits.

Benefits of Launching with Olympus DAO Clone Script

There are major benefits of adopting our Olympus DAO clone script:

Faster Time-to-Market

Traditionally, long-term and tedious application development has been the focal point of DeFi projects. In contrast, with a ready-made Olympus DAO clone script, the DeFi project can be launched immediately, and market traction can be built without further delay.

Protocol-Owned Liquidity (POL)

By introducing POL in the clone script, your platform can essentially own its liquidity instead of relying on a third party for the same. This helps to provide a long-term financial cushion and, in turn, reduces the chances of liquidity drain.

High Staking APYs

Since there are DAO governance modules within, the community members shall vote for changes and proposals that foster transparency and trust. The DAO should also ensure it will not affect the protocol decisions to reflect collective interest.

Decentralized Governance

With DAO governance modules built in, your community can vote for changes and proposals that provide transparency and trust. Ensure that it won’t affect the protocol decision to reflect collective interest.

Choosing the Olympus DAO clone is a critical decision in getting done with an efficient DeFi platform development. Instead of building each component from scratch full-time, it accelerates the deployment with full control in both tokenomics and governance design. Instances of such benefits warrant the understanding of the development process.

Step-by-Step Olympus DAO Development Process

If you ever wonder how to create a DAO, then the Olympus DAO by itself is an apt starting point, as it is nothing much, but the key compounds are fully functional decentralized autonomous organizations with barely any coding effort.

Step 1: Requirement Gathering & Project Strategy

Understanding the project goal, laying down its economic model, and identifying its target audience are involved here. It is better to make a solid road map at the inception to smoothly carry out the following stages.

Step 2: Clone Script Customization (Tokenomics, Rebase, Treasury Logic)

We then move on to customizing the Olympus DAO based on your unique tokenomics. We implement rebase logic, bonding curves, staking design, and treasury back-end logic powers in accordance with your protocol’s objectives.

Step 3: Smart Contract Deployment

DAO will set upon the smart contracts; it all puts together to secure and gas-optimize contracts for bonding, staking, governance, and treasury operations. Treasury. All these contracts will go through auditing and be verified before moving forward.

Step 4: Frontend & Admin Dashboard Customization

The frontend is responsive, quick, functional, and engaging to the users. Meanwhile, admins should have splendid control over the protocol. It will match your platform’s branding, tools, and refined UI/UX.

Step 5: DAO Governance Setup

Decentralized governance enables community members to take part in key decision-making processes. And now, native voting mechanisms, governance tokens, and proposals can be put into operation, realizing the full potential of the DAO.

Step 6: Testing and Auditing for Security

The functionality and smart contracts undergo testing with great scrutiny: several rounds of unit testing, integration tests, and third-party auditing to detect any possible bugs and vulnerabilities.

Step 7: Testnet & Mainnet Deployment

The protocol is first launched on the testnet to carry out the final validation of all features while simulating real user interaction. In the testnet, it’s time for mainnet deployment on the blockchain.

Step 8: Token Launch & Liquidity Bootstrapping

Once the post-launch of the platforms, the native token is launched, and bonding events or IDOs are out. Liquidity is bootstrapped through PoL strategies while the treasury grows, marking the beginning of user participation.

This structured procedure ensures your Olympus DAO clone is fully prepared to hit the real world.

Top Blockchain Platforms to Launch Olympus DAO Clone

The blockchain you choose plays a key role in how well your Olympus DAO clone performs and scales. Olympus clone scripts are supported across multiple platforms; each platform gives a different set of unique benefits.

- Ethereum

- Polygon

- Binance Smart Chain (BSC):

- Avalanche

- Fantom

- Harmony

- Solana (non-EVM)

Herein, each platform trades performance for cost and developer accessibility. Once deployed, your clone protocol can start generating revenue using built-in monetization methods. Let’s see how it makes money.

Launch an Olympus-Style DAO With an Olympus DAO Clone Script

Cost-effective | White-Label Solutions | Fully Customizable | Live Demo Available

Revenue Models Integrated in Our Olympus DAO Clone

Our Olympus DAO clone script constitution is built with diversification of revenue streams aimed at protocol sustenance and treasury growth.

- Bonding Fees: The protocol obtains revenues when users bond discounted tokens in exchange for some reserve assets.

- Staking Spread: A percentage of the reward rebases goes to the treasury to supplement long-term reserves by means of the staking spread.

- Treasury Yield: The idle treasury assets may be used to earn additional yield through various other DeFi strategies or LPs.

- Token Appreciation: The more adoption the protocol gets, the native token value appreciates, which directly benefits the treasury and early adopters.

- Protocol-Owned Liquidity (PoL): Funding-owning protocol LP tokens that earn trading fees forever; hence, the third-party liquidity providers in intermediary have decreased solicitation.

Each of these income streams supports the long-term health of the protocol and the foundation for DAO sustainability. The smoother the launch, the more it speaks about the strength of your development partner.

Why Choose Coinsclone for Olympus DAO Clone Script Development?

As a foremost DAO development company, Coinsclone is all about building robust and scalable DeFi platforms using Olympus DAO clone scripts. Our substantial experience guarantees that your DAO project is built for long-term viability. Here’s what distinguishes us:

- Expertise in DAO Architecture and DeFi Tokenomics: We study the economics and understand the governance structure that leads to success.

- Olympus DAO Clone Script: It will help you to save money and time while meeting great performance with a secure audit solution.

- Multichain Deployment Experience: We help you to launch on Ethereum or Solana as per your preference and according to your audience.

- End-to-End Development: Starting from smart contract writing to UI/UX to DAO Governance and treasury toolsets, we cover everything.

- Post-Launch Support: Continuous updates, upgrades, and technical maintenance are all on offer for a smooth running of the platform.

Partnering with us means that your protocol, inspired by Olympus DAO has, in fact, been built right from the bottom up. Still got more questions? Well,

FAQs – Frequently Asked Questions

1. What is an Olympus DAO clone script?

An Olympus DAO clone script is a pre-built DeFi software that replicates the key functions of the Olympus DAO protocol, such as bonding, staking, rebase mechanisms, and protocol-owned liquidity, so anyone can launch a similar decentralized reserve currency platform faster and with less development effort.

2. How does an Olympus DAO clone work?

An Olympus DAO clone works by running smart contracts that automate token rebasing, staking rewards, bonding discounted assets into the treasury, and decentralized governance. These systems aim to support a reserve-backed token and maintain liquidity through protocol-owned assets.

3. What features should an Olympus DAO clone script include?

Key features include staking mechanisms, bonding functions, treasury and liquidity dashboards, governance modules, rebase logic, wallet integration, and analytics tools to track treasury performance.

4. Can you customize an Olympus DAO clone script?

Yes. Most Olympus DAO clone scripts allow customization of tokenomics, governance rules, staking parameters, UI design, blockchain network support, and additional DeFi modules to match the goals of the project.

5. What is the difference between an Olympus DAO clone and the original Olympus DAO?

An Olympus DAO clone replicates the core mechanics of the original protocol (such as rebasing and protocol-owned liquidity) but is deployed independently, with its own governance, treasury rules, token design, and community choices.

See How Our MVP System Can Launch Your Olympus DAO Platform Faster

Olympus DAO Clone Script — Treasury-Backed DeFi Ecosystems Done Right.

- MVP System :Launch your community-owned reserve currency platform 90% faster.

- DeFi 2.0 Engine : Pre-integrated bonding, auto-compounding staking, and rebase logic—no complex smart contract coding required.

- Brand & Customization : Your native token name, your treasury rules, your UI, and your choice of blockchain (Ethereum, BSC, Polygon).

- Revenue Engine : Earn from liquidity pool fees, bond sales, treasury yield farming, and internal project incubation.

Get a free branded demo of your Olympus-like platform in just 48 hours — before you invest a cent.

Book a Free Call to discover how our Olympus DAO Clone Script can take you from idea to a live, treasury-backed platform in just 8–12 weeks.