The modern financial world is moving towards open, transparent, and globally accessible liquidity models. A DeFi lending and borrowing platform enables this by allowing users to lend crypto, borrow funds by collateralizing crypto, and earn interest. DeFi lending and borrowing platforms are based on the idea of decentralized lending pools to handle loans, interest rates, and repayments without the involvement of banks. Through the automation of blockchain, the development of DeFi lending and borrowing platforms makes it possible for startups and businesses to create scalable financial ecosystems that provide worldwide access to liquidity.

This blog provides you with everything you need to understand before you create your Defi Lending and Borrowing platform, including how it works, features, benefits, and how to develop one.

Let’s explore from the foundation….

See How Our MVP System Can Help You Build a DeFi Lending & Borrowing Platform Faster

DeFi Lending & Borrowing Development — trustless finance made easy.

- MVP System : Build your Compound-like lending protocol 90% faster.

- DeFi-Ready Modules : Collateralized lending, interest rate models, liquidation logic included.

- Brand & Customization : Your tokens, governance rules, UI, and preferred blockchain.

- Revenue Engine : Earn from lending interest, protocol fees, and staking rewards.

Get a free lending platform demo in just 48 hours — before you invest a cent.

Book a Free Demo to discover how our DeFi Lending & Borrowing Platform Development takes you from idea to live protocol in just 8–12 weeks.

What is a DeFi Lending and Borrowing Platform Development?

DeFi lending and borrowing development refers to the process of building blockchain-based platforms that allow users to lend crypto assets, borrow funds using collateral, and earn interest through automated smart contracts. Unlike traditional financial systems, these platforms operate without banks or intermediaries and run entirely on decentralized networks such as Ethereum or other smart contract blockchains. A DeFi lending and borrowing platform is designed to manage liquidity pools, collateral ratios, interest calculations, and repayments transparently while allowing users to retain full control over their digital assets.

Without any secondary thoughts, let’s have a deep look at…

How DeFi Lending and Borrowing Platforms Work?

The process of lending or borrowing is entirely automated through smart contracts to make it efficient, transparent, and user-friendly. Here’s a closer look at the step-by-step working process for both lending and borrowing.

Lending Process

- Deposit Funds- Lenders deposit their cryptocurrencies into a smart contract, creating a pool of funds.

- Interest Generation- Borrowers utilize these funds, and lenders earn interest based on supply and demand dynamics.

- Earnings- Interest is credited to the lender’s account via the smart contract, often in real-time.

Borrowing Process

- Collateral Deposit- Borrowers secure loans by depositing collateral, typically exceeding the loan value.

- Borrowing Funds- Loans are provided in supported cryptocurrencies, with algorithmically determined interest rates.

- Repayment- Borrowers repay the loan along with interest, unlocking their collateral upon full repayment.

DeFi lending and borrowing platforms are transforming the financial landscape by offering a secure, decentralized approach to cryptocurrency transactions. This innovative system continues to gain popularity, driving the growth of decentralized finance.

Core Features of DeFi Lending and Borrowing Platform

DeFi lending and borrowing platforms are equipped with robust features, many of which overlap with the process of creating a DeFi app, to provide users with a seamless and secure experience.

User Features

- Smart Contract Automation: Smart contracts handle all transactions automatically, from lending and borrowing to interest distribution. This eliminates intermediaries, reduces costs, and ensures transparency.

- Token Support: Most platforms support multiple cryptocurrencies, allowing users to lend or borrow a variety of digital assets based on their preferences.

- Algorithmic Interest Rates: Interest rates are dynamically determined by smart contracts based on the supply and demand of assets, providing fairness and stability.

- Non-Custodial Wallets: Users retain full control of their assets through non-custodial wallets, ensuring security and reducing the risk of hacks.

- Transparency: All transactions and data are recorded on the blockchain, offering full transparency to users and enabling audits at any time.

- Cross-Chain Functionality: Some platforms enable interaction across different blockchain networks, expanding the range of assets and increasing flexibility for users.

Admin Features

- Liquidity Pools: Users contribute funds to liquidity pools, which are used for loans. These pools ensure that funds are readily available for borrowing.

- Decentralization: The platform operates on blockchain technology, removing the need for centralized control, ensuring accessibility, and enhancing trust among users.

- Governance Mechanisms: Decentralized governance allows users to participate in decision-making processes, such as updates or fee adjustments, fostering community involvement.

- Monitoring and Analytics: This new form of data visualization and analysis provides a time-sensitive view of liquidity status, collateral health, loan demand, and revenue data faster & simpler.

- Emergency Shutdown: When an unexpected issue appears in a platform, you can use this secure mechanism to abruptly shut down the platform and stop the malicious activity.

- Risk Parameter Adjustment: Update collateral ratios, claims, liquidation fees, and loan rates to maintain the balance of ecosystem growth and manage risks effectively.

Security Features

- Collateralization: Borrowers are required to provide collateral, often exceeding the loan amount, to secure their loans. This minimizes risks and ensures lenders’ funds are safeguarded.

- Smart Contract Audits: Restrict access to sensitive administrator functions, and a third party verifies every contract to ensure that it does not contain vulnerabilities.

- Bug Bounty Program: Utilize a global network of potential hackers to identify possible vulnerability areas and work towards creating proactive methods for managing those vulnerabilities.

- Multi-Sig Controls: Increase the security access with multiple approvals from involved parties prior to the execution of any administrative functions, augmenting the security of users’ accounts.

- Non-Custodial Architecture: Users can keep full control over their assets and can cut out trusted third-party intermediaries instead.

Immutability & Transparency: Our platform is built upon a publicly maintained blockchain, which provides tamper-proof transactional activities.

Our Advanced Features to Power your DeFi Lending and Borrowing Platform

Often, modern DeFi users expect much more than simple lending. Innovative features such as our revenue models, inclusion of a wider variety of borrowers, and the ability for your liquidity to grow exponentially are making startups and enterprises partner with us.

- Flash Loans: We offer a fast way to borrow without collateral for options such as arbitrage, refinancing, or quick trading, with immaterial risk attached to either party.

- Insured Lending Pools: We set up pools of liquidity for lenders with insurance against sudden market movements and failing borrowers.

- Cross-Chain Bridge: Broaden your liquidity and the ability to access other assets by enabling seamless lending across different chain networks.

- Stablecoin Borrowing Options: Provide your borrowers with a steady means of low-volatility, fiat-pegged stablecoin liquidity provided by the US dollar or another major currency for predictable financial outcomes.

- NFT Collateralized Loans: Tap into the value of the non-fungible token marketplace by empowering property owners of these tokens with access to liquidity through collateralized loans.

- Referral& Loyalty Reward Programs: Increase user acquisition and retention with smart incentive programs that reward lending, borrowing, and staking.

Our Different DeFi Lending Development Approach

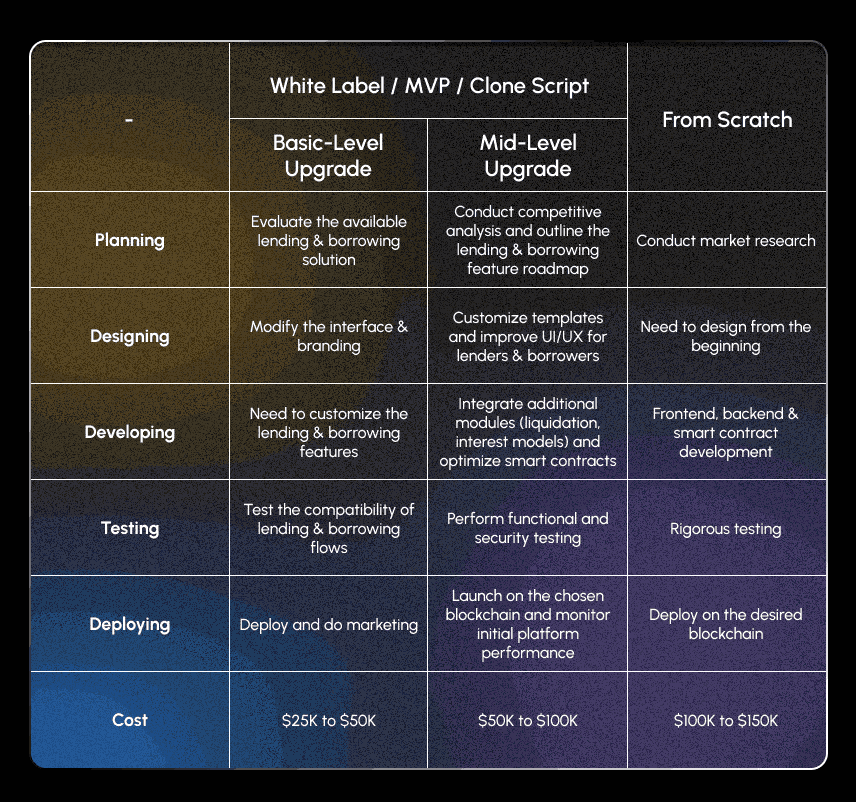

Each DeFi business is unique, and so is the way we build your platform. In addition to our different development strategies, we provide many options as per your timeline, customization requirements, and investment.

Custom Development From Scratch

We build your DeFi Lending and Borrowing platform from the ground up with a lending model, risk pools, Oracle integration, and governance workflows. This approach is ideal for startups and businesses planning to create a unique financial mechanism that supports cross-chain liquidity or functions in the regular market, adhering to compliance regulations. Developing a DeFi lending platform from scratch offers complete control over customization, complete ownership of the intellectual property, and the ability to develop it in the future.

White Label DeFi Lending and Borrowing Solution

Our White Label DeFi Lending and Borrowing Solution lets you enter the market quickly. We ensure that your platform is equipped with proven product features such as lending pools, collateralised borrowing, liquidations, and staking. Our White Label DeFi Lending and Borrowing software allows you to tailor the UI/UX, features, token support, and liquidity incentives. This method also minimizes engineering effort and any potential security vulnerabilities. Ideal for businesses seeking ready-made software with customization opportunities to be market-ready.

Hire DeFi Developers

When you hire our dedicated developers to build your decentralised DeFi platform, they assist you with

- Smart contract upgrades

- Improvements of liquidity modules

- Upgrades and audits associated with platform security

- Enhancements for scalability

This flexibility enables independent development of a DeFi lending and borrowing platform with ongoing technical expertise.

Our Diverse DeFi Lending and Borrowing Services

At Coinsclone, we cover every aspect of DeFi innovations. Our services help you to create a DeFi Lending and Borrowing platform successfully.

Smart Contract Architecture & Development

We create highly efficient and secure smart contracts that enable lending pools, interest rate models, collateralization methods, liquidation processes, and yield distribution systems. Our every contract is fully audited to ensure minimal gas fees, reliable performance, even in heavy network congestion times.

Tokenomics Design & Implementation

We develop sustainable economies to attract and retain liquidity. With this, businesses understand reward structures, mechanics governing inflation, token utility governance, liquidity provider incentives, and yield strategies. Our economic models are supported by both simulation and stress test results to guarantee long-term stability.

Enterprise Analytics & Reporting Tools

With our analytics and reporting tools, enterprises gain complete visibility into risk/collateral health, market liquidity utilization, revenue insights, user growth patterns, token supply, and annualized percentage yield (APY) performance. It allows businesses to make informed decisions about capital flow and profit margin improvement.

DAO-Based Governance Modules

We facilitate the community-based evolution through decentralized governance. Decentralized governance removes central control while simultaneously providing a platform for stakeholder participation and full transparency. With this service, you can empower your users to vote on protocol rules.

Non-custodial and Zero-Trust System Implementation

We support the core principles of “DeFi.” Users retain 100% ownership of their assets without depending upon a central authority. We provide zero-trust architecture with transparency and regulatory compliance. Our developers build reliable environments powered by cryptographic security, on-chain automation, and secure wallet integrations.

Cross-Chain Compatibility & Bridge Development

With this service, expand your lending operations, increase access to liquidity across diverse locations. Further, your users can lend on several blockchains, including Ethereum, BNB Chain, Polygon, Avalanche, Solana, and Cosmos. Businesses can reduce silos, broaden the accessibility of liquidity, and augment capital efficiency.

We build scalable and reliable DeFi platforms primed for market launch.

Our Latest DeFi Lending and Borrowing Application For Modern Businesses

Users demand simple, safe, and mobile-based solutions to access DeFi. Thus, we designed a DeFi Lending and Borrowing Application for businesses, desiring innovation.

DeFi Lending and Borrowing App

Our DeFi Lending and Borrowing Application integrates a seamless UI dashboard to view users’ deposits and yield. Borrowing modules quickly identify borrowing opportunities and perform automatic collateral evaluation. The application has a non-custodial wallet, and users can employ stablecoins to fund their lending transactions. With a few taps, your users can lend, borrow, repay, track yields, and manage collateral.

Whether you are a startup planning to enter DeFi or a business wishing to scale your platform, our app bridges your users with powerful innovations.

Benefits of Developing a DeFi Lending and Borrowing Platform

Developing a DeFi lending and borrowing platform offers numerous advantages for users, investors, and entrepreneurs. These benefits not only revolutionize traditional financial systems but also create opportunities for innovation and growth in the decentralized finance sector.

- Decentralization – Peer-to-peer transactions reduce costs and give users control.

- Accessibility – Global financial services for those without traditional bank access.

- Transparency – Blockchain ensures verifiable transactions, building trust.

- Automation – Smart contracts streamline processes and reduce errors.

- Higher Returns – Competitive interest rates make lending attractive.

- Flexibility – Supports various cryptocurrencies and financial choices.

- Security – Non-custodial wallets and blockchain protect assets.

- Market Growth – The expanding DeFi market offers profit opportunities.

- Customization – Features like cross-chain and governance tokens enhance platforms.

- Financial Inclusion – Provides loans and investments with fewer eligibility restrictions.

This platform unlocks numerous opportunities for transforming the financial landscape. By offering decentralization, accessibility, and innovation, such platforms cater to a growing demand for efficient and secure financial services, making them a promising venture for the future.

In the current era, the DeFi lending platforms are getting intense responses from both users and lenders. Presently, various lending platforms have got the attention of crypto users.

Cost to Develop and Revenue Potential of DeFi Lending and Borrowing Platforms

Developing a DeFi lending and borrowing platform may initially appear costly, but in reality, the investment can be more affordable than expected. The estimated cost for building such a platform typically ranges from $100K to $150K for development.

However, the actual cost can fluctuate significantly based on several factors, including the choice of development company, the complexity of desired features, and the integration of additional modules or functionalities.

What’s important to note is that cost and revenue are deeply interrelated factors in the development of a DeFi platform. The initial and ongoing costs for platform setup directly impact the platform’s ability to generate revenue. Below is a breakdown of the costs and revenue potential of DeFi Lending and Borrowing Platforms.

The cost of developing a DeFi lending platform is a strategic investment that impacts revenue potential. A higher initial investment can enhance functionality, attract more users, and yield better returns, while ongoing maintenance ensures user satisfaction and steady revenue.

We hope we’ve covered everything about DeFi lending and borrowing platforms. As a startup, your next step is to choose an experienced and reputable DeFi development company. At Coinsclone, we have the expertise to build a platform tailored to your business needs.

Our Structured Development Roadmap for Your DeFi Lending Business

At Coinsclone, we follow a structured development process designed to help your business take the idea to ongoing market success.

- Understanding Requirements: We work with you to understand your business goals, asset selection, and your method of generating income to create a defined development strategy that aligns with your intended marketplace vision.

- Architect the Platform & Smart contract: We create secure lending pools, rules for collateralization, and interest strategies using an architecture of smart contracts that support future modifications.

- Develop User Interface & Integration: We create seamless connectivity between users and wallets, using multiple chains to enhance the experience with lending and borrowing.

- Security audits & Testing: Every module we create undergoes extensive auditing, bug-testing, and risk simulations to ensure that both your users’ assets and your platform’s integrity are protected.

- Deployment: We deploy your protocol on the appropriate blockchain and provide complete support in onboarding liquidity in order to ensure a successful implementation experience.

- Post-Launch Support: We work with you to continually monitor and optimise your protocol for performance improvements, new features, and upgraded governance systems, to achieve maximum scalability.

Why Choose Coinsclone for DeFi Lending and Borrowing Platform Development?

Coinsclone is a leading DeFi Development Company with a proven track record of delivering secure, scalable, and feature-rich lending and borrowing platforms. Our expert team specializes in building customizable solutions with advanced security protocols and the latest technology to ensure high performance and user engagement.

With a focus on client satisfaction and success, we offer tailored DeFi Lending and Borrowing Platform Development Services that align with your vision, helping you stand out in the DeFi space. Partner with us to create a platform that thrives in the decentralized finance ecosystem.

FAQ – Frequently Asked Questions

1. What is DeFi lending and borrowing development?

DeFi lending and borrowing development is the creation of decentralized finance platforms that enable users to lend cryptocurrency, borrow assets using crypto collateral, and earn interest through smart contracts. These platforms operate without centralized institutions and automatically manage loans, interest rates, collateral, and repayments on the blockchain.

2.How does a DeFi lending platform work?

The platform pools assets from lenders into liquidity pools. Borrowers deposit crypto collateral and take loans. Smart contracts manage loan issuance, collateral checks, interest calculation, and repayments — ensuring trustless, transparent, and automated operations.

3.What services does a DeFi lending platform development company provide?

Services typically include smart contract architecture and coding, token and wallet integration, collateral & liquidation engine setup, liquidity-pool construction, cross-chain bridging, price-oracle integration, UI/UX design, platform deployment, and post-launch maintenance.

4.How secure is a DeFi lending platform?

When built properly, security comes from smart contracts, non-custodial wallet design, over-collateralization of loans, and transparent blockchain records — reducing risks of hacks or mismanagement. However, regular audits and proper risk parameters remain essential.

5.Can a DeFi platform support multiple cryptocurrencies and cross-chain assets?

Yes. A well-designed DeFi lending platform can support multiple crypto tokens and even offer cross-chain functionality — letting businesses and users leverage a wider asset base for lending and borrowing.

6.What does “liquidity pool” mean in a DeFi lending context?

A liquidity pool is a pooled collection of crypto assets supplied by lenders. These funds are made available for borrowers, and the pool enables automated loans and interest distribution using smart contracts.

7.What does “collateralization” mean, and why is it used?

Collateralization means borrowers lock crypto assets (often more in value than the loan) to secure their loan. This protects lenders by ensuring that if the borrower fails to repay, the collateral can be liquidated, reducing risk on the platform.

See How Our MVP System Can Help You Build a DeFi Lending & Borrowing Platform Faster

DeFi Lending & Borrowing Development — trustless finance made easy.

- MVP System : Build your Compound-like lending protocol 90% faster.

- DeFi-Ready Modules : Collateralized lending, interest rate models, liquidation logic included.

- Brand & Customization : Your tokens, governance rules, UI, and preferred blockchain.

- Revenue Engine : Earn from lending interest, protocol fees, and staking rewards.

Get a free lending platform demo in just 48 hours — before you invest a cent.

Book a Free Demo to discover how our DeFi Lending & Borrowing Platform Development takes you from idea to live protocol in just 8–12 weeks.